Since the turn of the millennium, the role played by CRMs in shaping and enhancing business processes has grown tremendously. They have evolved exponentially and the number of industries adopting the same has also grown. In this article, we are specifically focusing on how good insurance CRM can change insurance sales.

What is a CRM?

Businesses have inherent processes based on who their potential customers are. A Customer Relationship Management (CRM) Software helps organizations maintain a central record of their current and potential customers. This is, apart from helping them engage with these customers in an organized & intelligent manner. A good CRM should also be able to automate certain marketing & sales processes. Then, you can increase your internal productivity apart from enhancing your external relations.

The Insurance Landscape:

Over the years, the insurance sector has undergone quite the makeover. What started as a humble attempt to minimize an individual’s risk and transfer it to a bigger group, has now evolved into one of the largest industries on the planet. If there is one trait you generally associate with this area, it is that it involves high-velocity sales. This makes a lot of sense as a massive chunk of individuals can be identified as potential customers. And, each of them might need more than one type of insurance.

Features of a Good Insurance CRM

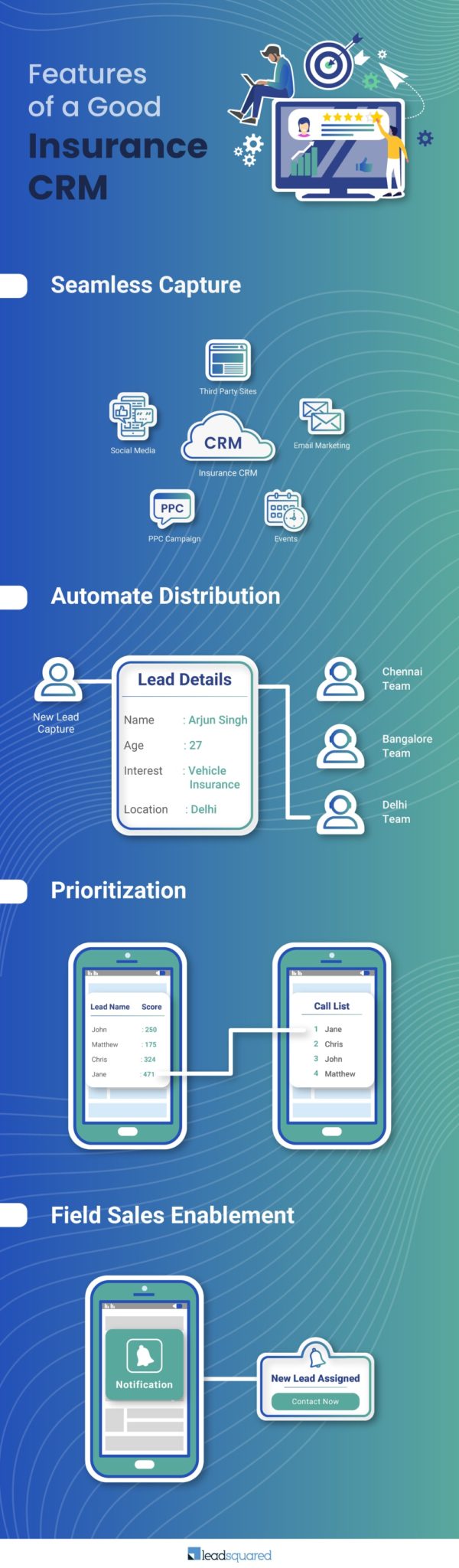

To club the good intentions of the insurance industry, and proficiency of a CRM tool, you need to have a good, and well-rounded, insurance CRM. Here are some must-have features that you should look for before making the purchase.

1) Seamless Prospect Capturing:

The first step to success for any organization would be to identify where they’re getting potential customers from. In today’s digitally advanced world, lead sources are extremely varied. This might include – social media, phone calls, website inquiries, referrals, etc. Therefore, you will need an effective lead management strategy.

In such a situation, the primary function of a CRM should be to effortlessly integrate with all such channels. It should capture every single inquiry without any leakage whatsoever. In doing so and by bringing them onto a single dashboard, the CRM helps in setting up a thorough and organized approach to reaching out to these prospects.

2) Automatic Distribution:

Once a lead is captured, it is important to allocate it to the right team to move it down your sales funnel. When the inflow is low, it is possible to pick & choose where each lead goes. However, this process isn’t feasible when you receive a sizeable number of prospects which is where the automation kicks in.

You can distribute leads depending on geography, type of policy interested in, agent availability or any other logic which complements your processes. You can even distribute leads to insurance agencies and call centers. This not only reduces manual effort but also improves the chances of conversion. Your team will now be able to work on leads almost as soon as they’re captured.

3) Prioritization:

After the lead is distributed to your sales agents or your contact center team, they should be able to rank the importance of each lead. Yes, this is an important step as not all leads coming in will carry equal weight. Understanding, where you should be putting your efforts first, is crucial if you want to increase your sales.

Prioritization, like distribution, can be customized as per the business flow. You can choose to give higher priority to leads coming in from a certain source, to those with certain financial characteristics or based on any other logic which will provide maximum value.

4) Field Sales Enablement:

We discussed how the insurance industry is defined by high-velocity sales. Most of these organizations have a huge fleet on the ground, selling various policies. In such cases, it becomes critical to empower these agents with a powerful mobile-friendly solution which helps them do all their tasks including planning their daily routines, keeping tabs of their meetings, adding renewals/fresh sales on the go, etc. It simplifies the tasks of insurance agents as well. With mobile apps, they can update the meeting notes, extract information, and more on the go. Such a solution will also give visibility to managers at different levels who will be updated in real-time about their team’s progress. This two-way benefit will play a significant role in boosting the entire sales team’s performance.

In conclusion

The ingredients which make up a good insurance CRM might seem endless but there are unified solutions which perform all these tasks. The biggest advantage of having a single system execute these functions is that your team will not have to switch between different tools which in turn is bound to improve their rate of work. Upon complete implementation, such tools also provide that extra edge in the quest to be more customer-centric and sell more insurance policies. You can also streamline customer support with Insurance CRM software.

If you are looking for one for your own business, I’d recommend LeadSquared. You can take a quick trial or an online demo.

Related:

![[Roundtable] From Traditional to Digital: Building a Customer-Centric Insurance Strategy](https://www.leadsquared.com/wp-content/uploads/2024/07/insurance-RT-popup-1.gif)