All the technological resources that real estate professionals employ is what we call Proptech.

Proptech companies use these tools to streamline the processes involved in buying, selling, researching, marketing, and managing real estate.

Real Estate Tech, Retech, or Realtech are other names for this cutting-edge technology. Proptech is a word that denotes the solid integration between real estate and technology. Propetch comes in a variety of forms and the most common are:

- Platforms for real estate search

- Tools for financing property sales

- Tools for planning and managing constructions

The CAGR for the PropTech market is forecast to be strong at 16.8% from 2022 to 2032. The size of the proptech market is set to increase from US$ 18.2 billion in 2022 to US$ 86.5 billion in 2032. The daily grind of practically every player in the real estate industry has been drastically altered by Propetch. The top advantages of Proptech include:

- Proptech guarantees efficient communication with customers, contractors, and other stakeholders.

- With the help of smart sensors, extensive 24/7 insights into how renters use the space are now accessible.

- Cost reduction & workflow automation in the real estate sector.

Proptech companies are constantly evolving to meet the changing consumer needs. This article will highlight the top proptech businesses that are widely recognizable. Let’s get right into it!

1) Hover

Website: https://hover.to/

Address: 634 2nd St, Floor 3, San Francisco, California 94107, US

Employee Size: 101-250 employees

Funding: The total funds raised from 2012 to 2020 is $127.3M. The key investors were State Farm Ventures, Nationwide Mutual Insurance, and Travelers Insurance.

About Hover:

Hover, the first propetch on our list gives consumers a lifelike picture of the place they buy. Their 3D technology helps create and enhance data using crowdsourced photography and other sensors.

They turn smartphone pictures of any property into a completely measured, modifiable 3D model. This allows us to reliably assess a project and quickly envision how it will turn out. Hover is best suited for homeowners, insurance agents, and exterior contractors.

Hover’s top USPs are:

- Hover is one of the first 3D full-scale, live-home model creation apps. They ensure that users receive highly accurate representations of their would-be home.

- You can also use the dimensions given in the app when choosing interior design features. Direct purchases of various goods and resources are possible via the app.

- Customers can also utilize 3D technology to picture how a specific item, like new skylights or a ceiling, might appear in a home.

Customer Testimonial:

“The 3D Model is way more effective at visualizing what the homeowner’s house will look like in the future. It gives homeowners the confidence.”

Caleb Mitchell

2) Lessen

Website: https://www.lessen.com/

Address: Scottsdale, Arizona, US

Employee Size: 201-500 employees

Funding: The total funds raised by Lessen from 2019 to 2022 is $235M. The key investors were Legacy Knight Fifth Wall and Khosla Ventures.

About Lessen:

The marketplace platform Lessen brings together service providers and property owners. Their goal is to provide property services more effectively, swiftly, and affordably than ever before.

Solutions for property service outsourcing are available through the Lessen platform. This involves automating the lifecycle management of all property services. It conveniently links property owners to a network of vetted experts around the US.

The business provides real estate owners with the following:

- On-demand resources

- Consistent service cost

- Property servicing, maintenance, and repairs

- A portal that offers a steady job flow for service providers

- Immediate payment

- Comprehensive job specifications

- Simple job scheduling where they assist real estate owners and providers to complete the work efficiently

“Through our partnership with Lessen, we alleviate much of our back-office service management work and save substantial time, money, and effort compared to our old approaches.”

Lessen Client, CEO, Property Management Company.

3) Reonomy

Website: https://www.reonomy.com/

Address: 6E, 32nd St, New York, 10016, US

Employee Size: 51-200 employees

Funding: The total funds raised by Reonomy from 2013 to 2020 is $128.4M. The key investors were Bain Capital Ventures, Sapphire Ventures, SoftBank Capital, and Georgian.

About Reonomy:

Reonomy is a cloud-based realty analytics tool. It combines machine learning and artificial intelligence on a single system. This significantly helps real estate organizations identify prospects and manage threats.

Clients of Reonomy can look for:

- Commercial real estate by location

- Most recent purchase date

- Client portfolio

- Asset class

- The date of loan origination

- Home value

Real estate agents typically use the solution to research homes and neighborhoods. The key USPs of Reonomy are:

- Users can access information about any area, remodeling details, pay, debt, sales, or tax history.

- Owners can design unique feeds to assist users in their quest for commercial real estate information.

- Users can view predictive analytics and map fragmented or missing records to their sources.

Customer testimonial:

“We were never completely satisfied with any other platforms. It seemed like each resource had its good data points, but also its challenges. Reonomy is a wonderful marriage of all of those systems.”

Allen Buchanan, Principal, Lee & Associates

4) Opendoor

Website: https://www.opendoor.com/

Address: 116 New Montgomery Street, San Francisco, CA 94105, US

Employee Size: 1,001-5,000 employees

Funding: The total funds raised from 2014 to 2020 is $1.9B. The key investors were BlackRock, SV Angels, GGV Capital, and Hawk Equity.

About Opendoor:

Opendoor enables people to sell a house promptly and get a bid on it in just a few clicks. They eliminate risk and ambiguity from the transaction through this approach.

Opendoor first carries out large-scale home buying. After which they flip and sell the properties on the competitive market. Their service fee is a representation of the carrying and resale prices.

Opendoor’s most popular offerings are:

- Opendoor ensures that they carry out all necessary repairs to a home before the resale. This makes moving and settling in a lot smoother for home buyers.

- The company confirmed that it retains properties for an average of 90 days in 2019. In contrast to how long it often takes for sellers to make a deal, this is a shorter time frame.

Customer Testimonial:

“We didn’t want the extra stress of buyers backing out, financing delays, all that. That’s when our agent suggested to selling to Opendoor, and it was such a smooth sale.”

Kurt and Christie Ohlenbusch

5) Zumper

Website: https://www.zumper.com/

Address: 555 Montgomery, San Francisco, CA 94111, US

Employee Size: 201-500 employees

Funding: The total funds raised from 2014 to 2022 is $178.7M. The key investors were Kleiner Perkins, Goodwater Capital, and Greycroft.

About Zumper:

Zumper is a rental service that enables users to share rental ads and receive monthly payments. It was initially designed for property management firms. Agencies and landlords may quickly connect with tenants by listing any sort of property on Zumper’s home and apartment locator.

Realtors and landlords use Zumper’s comprehensive background screening services to check every potential tenant before they move. Renters can make secure digital payments for their rent through the tenant site or the mobile app.

Their top USPs are:

- They are one of the few rental proptech apps that helps increase visibility when putting homes for rent.

- Each listing also offers in-depth information regarding the rental property. Some of which can include images of the property, fixtures inside, and their value.

- To guarantee that the website content is precise and recent, Zumper’s MLS feeds regularly update listings.

Customer Testimonial:

“The ability to not only create an attractive profile that is not just accessible through Zumper but the hook in with the other software like padmapper was a seamless and effective tool. I also liked the fact that every possible option I could think of for items and filters has already been thought of before. Nothing worse than trying some new program and discovering that the product really isn’t finished!”

Stephen W

6) HomeLight

Website: https://www.homelight.com/

Address: San Francisco, US

Employee Size: 201-500 employees

Funding: The total funds raised from 2016 to 2022 is $742.5M. The key investors were Zeev Ventures, SoftBank Vision Fund, and Group 11.

About HomeLight:

San Francisco-based real estate referral business, HomeLight, uses real estate technology and the Internet as a marketing tool. HomeLight connects with a network of real estate agents in different markets to whom they refer clients. The business connects house sellers with regional real estate brokers.

Since its founding in 2012, HomeLight has listed more than $3 billion worth of properties. The business uses its algorithm based on specialized knowledge and qualifications to examine over two million agents. Its most popular features are:

- Agent recommendations made by HomeLight depend on sales performance. Typically, a top-performing agent will be your match. Moreover, they are generally excellent at selling properties similar to yours.

- You don’t have to wait for HomeLight’s algorithms to locate you if you’re a realtor. The website provides resources that can help you become more accessible.

- The appropriate real estate agent might make all the difference if you need to sell quickly. The matching tool from HomeLight directs you to the agents who will sell your house for optimum profit.

Customer Testimonial:

“Using HomeLight made it easy to find the top real estate agent in our area. The process from beginning to end was so quick and easy. Our agent got to work right away and was very confident in the listing process. Our home went under contract just 2-3 weeks and sold quickly!”

Cory Ft. Loramie

7) Qualia

Website: https://www.qualia.com/

Address: San Francisco, California

Employee Size: 501-1,000 employees

Funding: The total funds raised from 2015 to 2020 is $160M. The key investors were Tiger Global Management, Menlo Ventures, and Human Capital.

About Qualia:

Qualia is an all-in-one title production tool that streamlines internal processes and promotes effectiveness. Furthermore, it promotes and enhances client relationships.

With customizable workflows, Qualia enables the quick processing of title and escrow orders. All parties’ communication and knowledge benefit with the help of these workflows.

With Qualia, completing a file doesn’t need using several systems or rekeying data. Without tedious setup and maintenance, users may:

- Manage and modify various workflows,

- Allocate tasks to people or groups depending on contingencies, and

- Generally, optimize their workflow management operations.

Qualia’s best features are:

- Qualia offers document management capabilities ensuring its processes are paperless. They offer a built-in e-signature capture tool making transactions much faster.

- It simplifies the development, approval, and compliance of papers and contracts related to real estate.

- Additionally, Qualia enables the complete transaction workflow, covering listings and commissions.

Customer Testimonial:

“Qualia was the single source of truth to have the visibility of all the parties I was communicating with and the documents I needed… it really helped me to keep track of every step in the process.”

Justin Swisher, Homebuyer

8) VTS

Website: https://www.vts.com/

Address: 119 W 40th St, New York, 10018, US

Employee Size: 201-500 employees

Funding: The total funds raised from 2013 to 2021 is $337.4M. The key investors were CIBC Innovation Banking, Brookefield Growth, and Insight Partners.

About VTS:

VTS is software for CRE leasing and wealth management. VTS specializes in empowering agents, renters, and property managers by centralizing essential data and workflows in one location.

VTS 3 has a user base of more than 34,000, commercial real estate spanning over 10 billion square feet. Their USPs are:

- VTS offers in-depth cash-flow analysis with lifecycle management for your assets.

- Similar to a CRM, VTS’s technology offers robust tracking features. Additionally, the tool gives interaction tracking, reminders, notifications, and more.

- It drives lead generation and commercial property management with the help of reports and analytics.

Customer Testimonial:

“VTS is a great Asset Management and Leasing Tool. It allows an asset manager to physically see the real-time leasing activity, stacking plans, lease roll, and more. VTS neatly organizes all the leasing activity in one location, allowing me as a leasing broker to visually see the deals I am working on and continue to move the ball forward with each one.”

Andrew R

9) Pacaso

Website: https://www.pacaso.com/

Address: San Francisco, US

Employee Size: 51-200 employees

Funding: The total funds raised from 2020 to 2021 is $1.5B. The key investors were SoftBank Vision Fund, Greycroft, and 75 & Sunny.

About Pacaso:

Co-founders Spencer Rascoff and Austin Allison, both former executives at Zillow, created Pacaso in late 2020. Owners can purchase fractional interests in second residences. The best thing is that this is feasible in approximately 25 second housing markets across the US.

Customers greatly benefit from the comfort of second home ownership. They don’t have to deal with the difficulties of timeshare, house, or Airbnb ownership. This is all due to its existing business strategy.

Its best features are:

- Pacaso uses an LLC to buy a house, then offers clients one-eighth shares of the building. Customers have the option to purchase one to four shares in a property they intend to utilize.

- They help identify properties, decorate them, cover repair costs, and organize each owner’s time.

Customer Testimonial:

“One of the things I love about our Pacaso is having easy access to a beautiful home, that feels like home, where we can come together with friends and family.”

Susan, Home owner

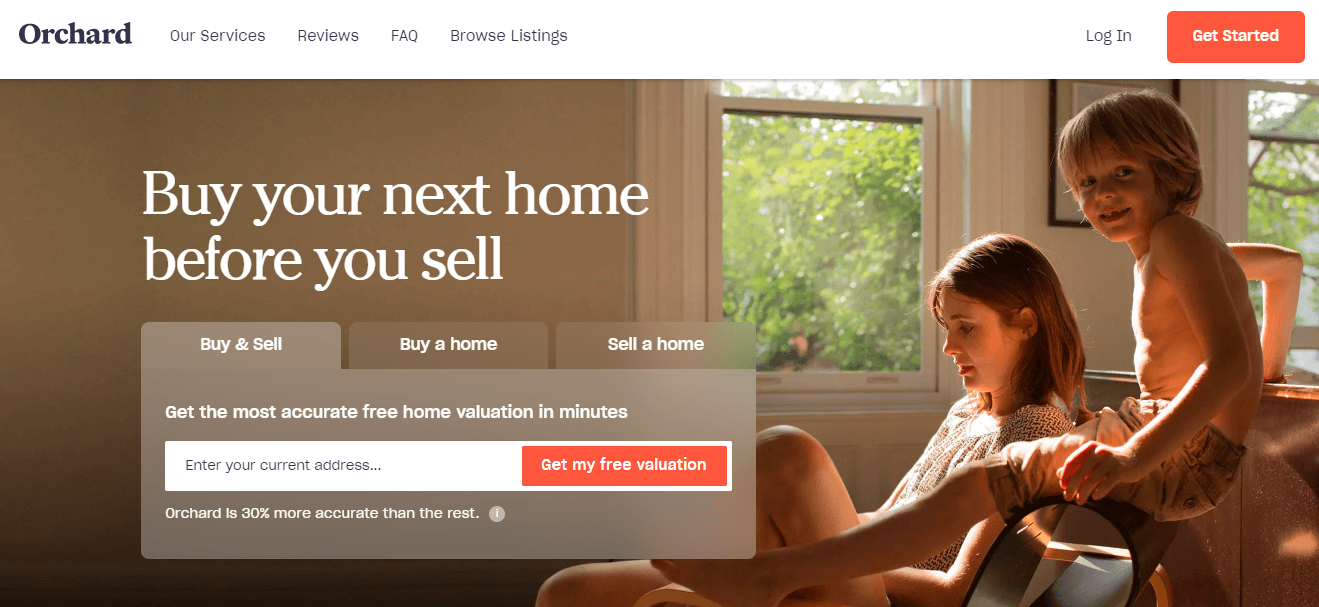

10) Orchard

Website: https://orchard.com/

Address: New York, US

Employee Size: 501-1,000 employees

Funding: The total funds raised from 2018 to 2021 is $427M. The key investors were Accomplice, First American, and Navitas Capital.

About Orchard:

Orchard is a firm that provides its clients with several indispensable tools. Through the List with Orchard service, customers of Orchard can list their house for sale and get a sure backup offer from the company. Additionally, they can use Move First to purchase a new home before selling the old one.

Through their Buy & List feature, the business may offer a more conventional selling experience at a lower cost. With Offer Boost, they may even convert customers into cash buyers, increasing bid competition.

Orchard’s most popular use cases are:

- Similar to Hover, Orchard offers a 3D home tour for its users. But unlike Hover, they do not offer in-depth measurements of the property.

- Suggestions for improvements and repairs. They also offer project management, which is available with their Concierge feature.

- Your home has a 120-day listing window with Orchard. If it doesn’t sell during this time frame, Orchard will purchase your house outright for a set sum.

Customer Testimonial:

Our research methodology

All the real estate firms on our list are developing new technology to enrich user experiences. These firms are creating new business models and completely reimagining customer journeys, from finding rentals to obtaining loans.

Real estate agents need to invest in such tools to tackle the housing market of the future. Some of the tools on this list may be exactly what you’re looking for. And if you’re wondering what the criteria for this list were, my shortlisting method was:

- First, narrowing down companies with unique offerings. Only two of the options on this list fall under similar offerings. But both options, Hover and Orchard, differ in the complexity of services. For instance, Hover’s 3D models are highly comprehensible and detailed. In contrast Orchard’s 3D home tours are not as in-depth or informative.

- Second, companies that offer services for buyers, renters, borrowers, and more. Most people view Proptechs as tools that only help real estate agencies. But several options make the homeowner’s lives easier.

- Finally, all the companies on this list have largely positive customer reviews and experiences. None of the companies in this list have a rating lower than 4 on most reviewing websites.

I hope this list of top 10 Proptech companies in United States helps.

If you’re looking for a Real Estate CRM software to level up your game, we’re here for you.

Book a quick demo to know how to increase your property bookings by 10X!

![[Webinar] Real Estate Evolution in India: A Glimpse into the Future](https://www.leadsquared.com/wp-content/uploads/2024/04/Automation-webinar-popup.gif)