Good customer service is key to any business’s success. In fact, it converts 81% of buyers into repeat customers! Once businesses understand what customers want and design a product/service to fit their requirements, the journey ahead is somewhat straightforward. But, for long-term growth, focusing on customer satisfaction helps them retain most of their users.

This guide explains what customer retention is, its importance, how to calculate customer retention and tips to improve it!

Let’s get started.

What is customer retention?

Customer retention refers to the activities and actions taken by a business to retain its existing customers over a specified period of time. Irrespective of the industry you belong to, customer retention plays a key role in boosting the sales bottom-line.

Customer retention may be in the form of maintaining subscriptions or encouraging repeat purchases, for different companies. Providing proactive customer support and personalized recommendations are a couple of ways in which businesses target to retain customers. Businesses can track the effectiveness of their retention strategies by calculating the customer retention rate.

How to calculate customer retention rate?

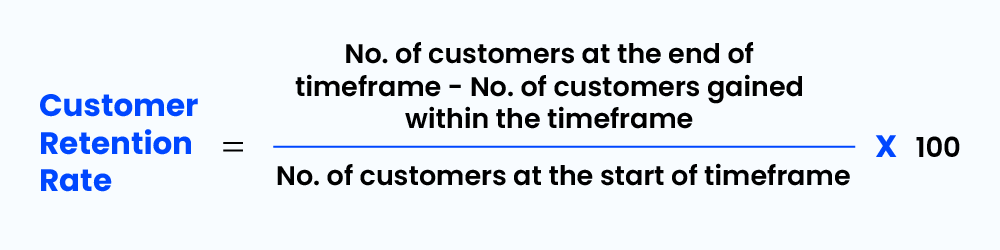

Customer Retention Rate measures the number of customers a company retains over a given period of time.

The customer retention rate is calculated by first subtracting the number of customers gained in a certain time frame from the number of customers at the end of the period. The resultant figure is then divided by the number of customers at the beginning of the period. Multiply it by 100 to get the customer retention rate percentage.

The formula for the same is as follows:

For example, if your business has 100 customers at the beginning of the year, acquired 20 more customers throughout the year but lost 10 of them due to some reasons at the end of the year, here’s how to calculate the customer retention rate.

Customer Retention Rate (CRR) = (110-20)/100) *100 = 90%

What is an ideal customer retention rate?

In the most ideal situation, the customer retention rate for businesses would be 100%, which is quite unrealistic. However, the average customer retention rate across industries ranges from 70-80%.

A high customer retention rate indicates that the customers are happy with their purchases and are willing to contribute to a sustainable source of revenue. On the contrary, a low customer retention rate may lead to a potential loss in revenue, which requires you to review your customer retention strategies.

There are a couple of factors that can improve customer retention rates for both B2B and B2C businesses. Let’s look at them in the next section.

Factors that impact customer retention rate

1. Transparency and trust

There is a very low chance of customers leaving a company they trust. Once customers believe in a company, they will come back for more products and services, leading to a higher retention rate. While transparency and trust are important for both B2B and B2C businesses, they take a center stage for B2B enterprises where long-term and personal relationships are integral. B2C businesses can’t build a one-on-one relationship with buyers but trust plays a role in establishing an emotional connection between customers and brands.

2. Customer Support

Since B2B is built on long-term relationships, customers require dedicated support from the team due to large-scale purchases and the complexity of products/services. Providing excellent customer support and timely issue resolution foster customer loyalty. In B2C companies, customers seek convenience and easy-to-access products and services. Thus, offering seamless purchasing experience, quick delivery, and hassle-free returns are a couple of ways they can gain customer loyalty.

3. Customization and Personalization

Customization or personalization plays a vital role in the customer retention process. When customers feel that the company understands their unique requirements and cater to it, they are more likely to stay with the brand.

Similarly, addressing customer problems and providing solutions that align with their interests make the customers stay inclined to the company. B2B can tackle this factor by providing tailored solutions to the buyer’s requirements. Whereas B2C companies use customer data and browsing history to provide personalized product recommendations using targeted marketing campaigns.

4. Brand Perception and Reputation

Brand perception is how a company is perceived by its potential as well as existing customers. It is an important factor that influences how other businesses, clients, and industries view a company. Positive reviews online, word-of-mouth, and customer testimonials can influence consumers to stick to a brand.

5. Purchase Frequency

Purchase frequency refers to how frequently a business makes a purchase from a supplier. It influences B2B and B2C differently. For example, the purchase decisions in B2B are comprehensive and involve more stakeholders, elongating the sales cycle. Thus, purchase frequency is less in B2B when compared to B2C.

Encouraging repeat purchases through loyalty programs, rewards, and incentives can help both B2B and B2C businesses improve customer retention.

These factors definitely affect your customer retention in some way. But customer retention varies based on the industry you belong to too. You need to know the benchmarks for your own industry before you alter your retention strategy in any way.

Industry-wise benchmarks for customer retention rates

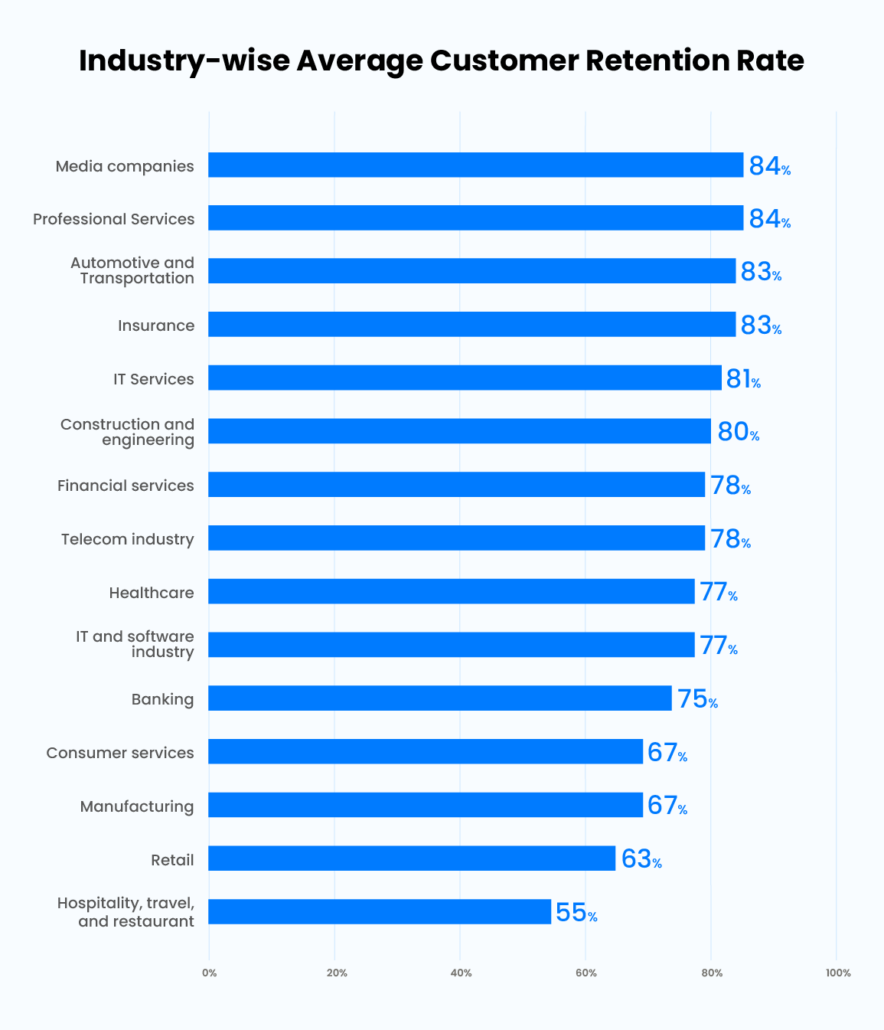

The frequency of customer visits to different businesses, such as grocery stores, mobile applications, or high-end fashion retailers, vary significantly, ranging from short intervals to extended periods spanning years. Consequently, the customer retention rates differ as well.

For example, in the banking sector, the average retention rate is relatively high, at 75%. This is because customers typically maintain their bank accounts at a single institution and incur monthly fees. On the other hand, the hospitality industry, which encompasses restaurants, experiences a comparatively lower retention rate of 55%. Despite the frequent dining out culture, the customer retention rate is lower due to the abundance of available options.

Here is the average global customer retention rate in 2023 across different industries:

If you find your business to fall under the average customer retention rate for your industry, we have a few actionable tips to help you improve it!

5 Tips to Improve Customer Retention Rate

Companies across the world use different strategies to increase customer retention rates and initiate more purchases. Here are few measures:

1. Improve customer experience

A seamless and smooth customer experience ensures that customers return to your company. Thus, it is important to ensure you build such an experience for customers right from presales to payment, and even with the customer service offered after they’ve completed a purchase.

2. Introduce a customer loyalty program

Customer loyalty programs are designed to acknowledge customers who consistently engage with a particular brand. To build a loyalty program that boosts customer retention, businesses need to:

- Craft targeted campaigns based on customer data

- Add tangible rewards

- Make their loyalty programs easily accessible

3. Build ongoing relationships

Discover ways to deliver value to customers. For instance, if your company specializes in selling mechanical equipment, you could explore options like implementing a service program or offering complimentary annual check-ups for all purchases. By transforming a singular transaction into a long-term service-oriented relationship, you can enhance customer retention and solidify your position as their preferred vendor.

4. Engage with customers via different channels

Foster stronger connections, community, and engagement with customers through various means such as organizing in-person events or hosting digital panels and forums. Additionally, a company can creatively engage with their customers on social media platforms to build and maintain connections with them.

5. Plan strategic sales and marketing outreaches

Maintaining brand presence involves strategically planning outreach around significant events in the customers’ journey. For instance, creating an informative and engaging email newsletter can both entertain subscribers and enhance brand recognition. In addition to advertising and promotional efforts, businesses should explore funny and relatable marketing campaigns that entertain customers.

Once you implement these tips, you also need to track how effective they are for your business (Or, you can just take our word for it! 😉). The customer retention rate is the most important metric to assess your retention strategy, but there are a few other related metrics that you can track.

Customer retention metrics and how to measure them

Customer Retention Metrics refer to the variables or factors that can be used to measure the likelihood of retaining a customer. These metrics are used by companies to make decisions that boost business growth.

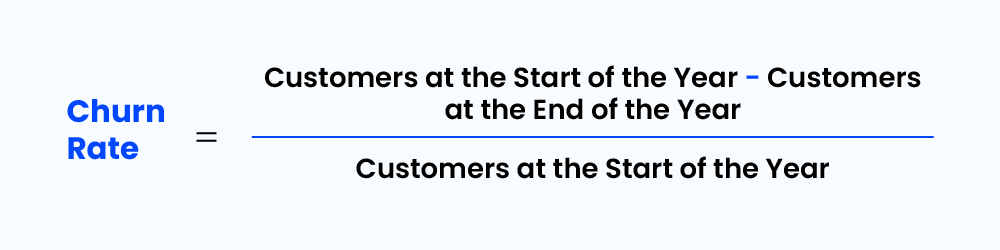

1. Customer Churn

It is the rate at which a company loses its customers within a specific time frame.

Formula for customer churn:

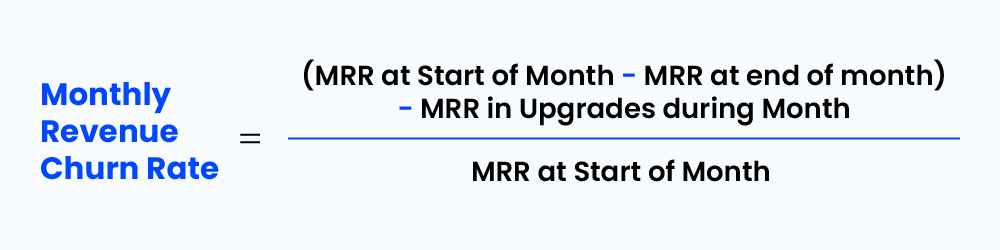

2. Revenue Churn Rate

It is the percentage of revenue the company has lost from the existing customers in a specific time period. It can be a result of a cancelled order, a plan downgrade or the end of a business relationship. The revenue churn rate is usually calculated in monthly intervals.

Formula for Monthly Revenue Churn Rate:

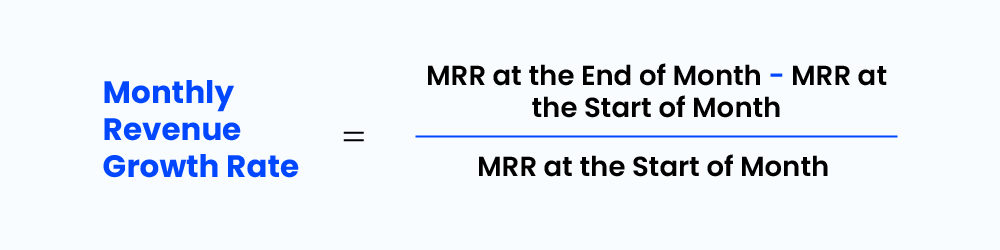

3. Existing Customer Revenue Growth Rate

It is the rate at which a business generates revenue from customer success. It is important for businesses because sales generated from existing customers are 60-70% while those generated from new customers are only 5-20%. Acquiring a new customer is more expensive than upselling a current one as well.

Formula for Revenue Growth Rate:

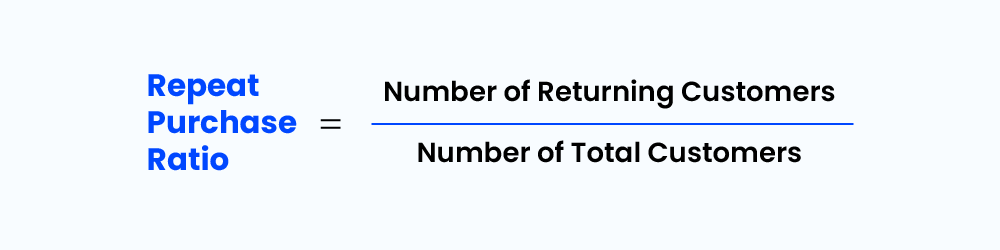

4. Repeat Purchase Ratio

As the name itself implies, it is the rate at which customers come back for another purchase. This metric indicates customer loyalty, a term used by sales and marketing to assess the performance of their customer retention strategy. This can be calculated in any time frame – weekly, monthly, quarterly and so on.

Formula for Repeat Purchase Ratio:

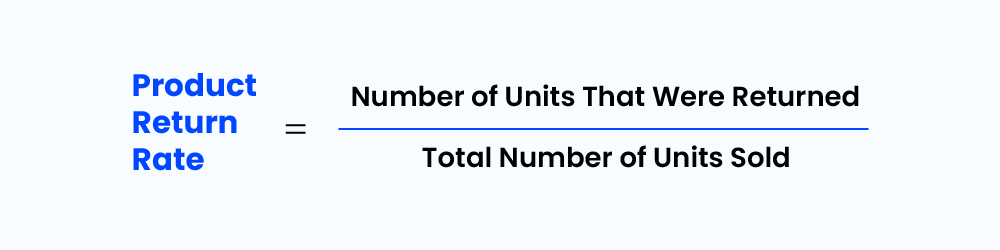

5. Product Return Rate

- Product Return Rate is the rate at which products are returned or the proportion of total units sold that have been sent back to the company itself. Though products can be returned for various reasons, returns are not good, and businesses should aim to lower this rate.

Formula for Product Return Rate:

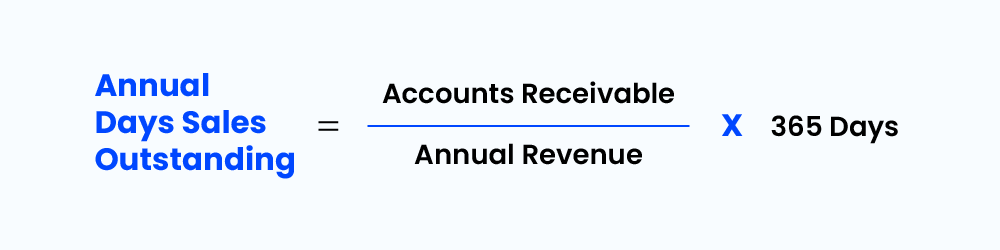

6. Days Sales Outstanding (DSO)

DSO is the total number of days taken to collect payment from a sale. A longer DSO negatively impacts customer retention as it indicates that a customer is dissatisfied with the company’s product or service, or the marketing and sales teams are closing customers with credit or cash flow problems.

Formula for Day Sales Outstanding:

7. Net Promoter Score

The Net Promoter Score (NPS) measures customer satisfaction and how likely customers are to refer a business to others. It can also be used to find out if customers are content and willing to refer the company’s products or services to others.

To calculate NPS, the customer is asked to choose a score between 0 and 10. Out of the scores, only 9’s and 10’s are promoters, and a rating of 6 or below is considered to be a detractor.

Thus, Net Promoter Score can be calculated by subtracting the percentage of detractor responses from the percentage of promoter responses.

Formula for Net Promoter Score:

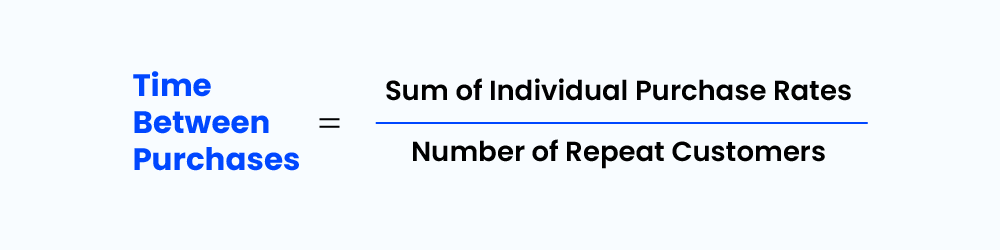

8. Time Between Purchases

Time Between Purchases measures the average time customers take to repeat a purchase or make a new one. It is an important retention metric as it shows how happy or satisfied customers are with a product or service and how willing they are to try competitors in the market.

To calculate the average time between purchases, one needs to know the purchase dates for all customers. Once it is ready, add every customer’s average purchase rate and divide that number by total repeat customers. It is mandatory to exclude any new customers, as this metric should only measure existing ones who made repeat purchases.

Formula for Time Between Purchases:

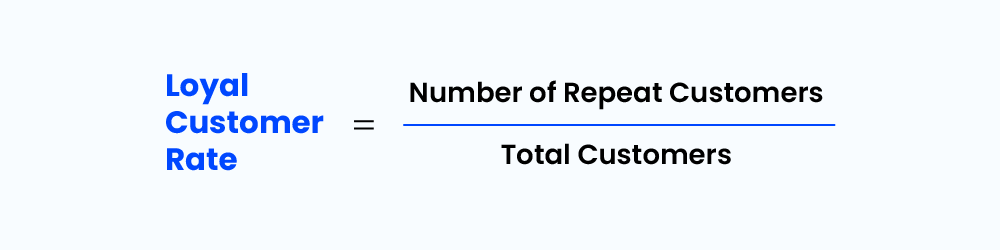

9. Loyal Customer Rate

Loyal Customer Rate measures the number of customers with repeat purchases over a time period. It identifies the most valuable percentage of customer base that demonstrates loyalty to your business. They are not only the ones to drive the most sales but are also the most likely to share positive word-of-mouth about the business.

Formula for Loyal Customer Rate:

10. Customer Lifetime Value (CLV)

Customer Lifetime Value measures how much revenue is generated by a single customer from individual products/services or through upgrades.

Formula for CLV:

Conclusion

Businesses that wish to strive in today’s highly competitive landscape must consistently track and calculate their customer retention rate. This metric provides valuable insights into customer loyalty, satisfaction, user experience and overall business performance. Understanding the customer retention rate and taking measures to improve the same helps businesses stand out and build valuable connections with customers.

To achieve the same, an efficient CRM like LeadSquared can help you gain a competitive edge. LeadSquared CRM is capable of enhancing customer retention process by managing customer interactions, history and thereby providing a personalized user experience. The dashboards and reports on the tool give you complete visibility into sales performance by allowing you to track customer retention metrics on the platform. As a result, it has helped businesses decrease their churn and improve overall revenue. To know how, you can book a demo with our team today!

FAQs

Customer Retention is measured to understand how successful companies have been at satisfying existing customers. It also increases ROI, boosts loyalty and brings in new customers.

A 100% customer retention rate means you did not lose even a single customer, while a 0% retention rate means you lost all of them.

The customer retention rate is the proportion of customers who stay even after a specified time period, whereas the turnover rate is the proportion of customers who leave after a specified time period.

![[Webinar] Maximizing ROI with WhatsApp CRM](https://www.leadsquared.com/wp-content/uploads/2024/07/Maximizing-ROI-with-WhatsApp-CRM-webinar-popup.gif)