As customers, we all desire brands that prioritize our needs and preferences, don’t we?

In today’s market, personalized experiences are increasingly valued over being treated as just another number in a crowd. This sentiment holds particularly true in the financial services sector, where alongside established market leaders, numerous challengers vie for attention.

With the power to switch between service providers, customers are now empowered decision-makers, driving the need for brands to truly understand and connect with them.

Recognizing this scenario, marketing remains pivotal in humanizing the brand and building customer affinity within the financial services industry.

By using marketing automation tools, institutions can develop their approaches, enhance engagement, and forge meaningful connections with their audience.

In this article, we delve into the benefits of marketing automation, exploring strategies to move away from aimless marketing efforts towards purposeful initiatives that resonate with customers in the financial services industry.

What Is Marketing Automation?

Marketing automation simply means using software solutions to automate marketing campaigns across multiple channels. Typically, when processes are repetitive and are done for high volume, they have the scope to be automated to ensure consistency and mitigate manual errors.

Importance and Relevance of Marketing for Financial Services

While other industries plan marketing initiatives that help customers make a purchase, the approach for marketing can be slightly different in financial services.

For financial institutions, marketing is more than just brand building. It’s about using marketing to garner trust and the value that they provide to the customer.

For example: The India-based fintech, CRED, rewards users for paying their credit card bills on time.

It has gained immense popularity for their creative take on marketing over the years.

One of their ad campaigns from 2021 focused on the message ‘greater for the good’, since they have exciting reward programs for users who pay their credit card bills on time, therefore creating exclusivity by catering to just creditworthy people.

The concept of the ads associated with this campaign can be further understood. For example, one of the ads featured Rahul Dravid being angry, to signify how having to reward good behavior is unbelievable.

Check out one of the ads from this campaign here:

This not only signifies the quality and their approach to reward programs, but also how they’re positively reinforcing customer behavior to use CRED with a sense of exclusivity.

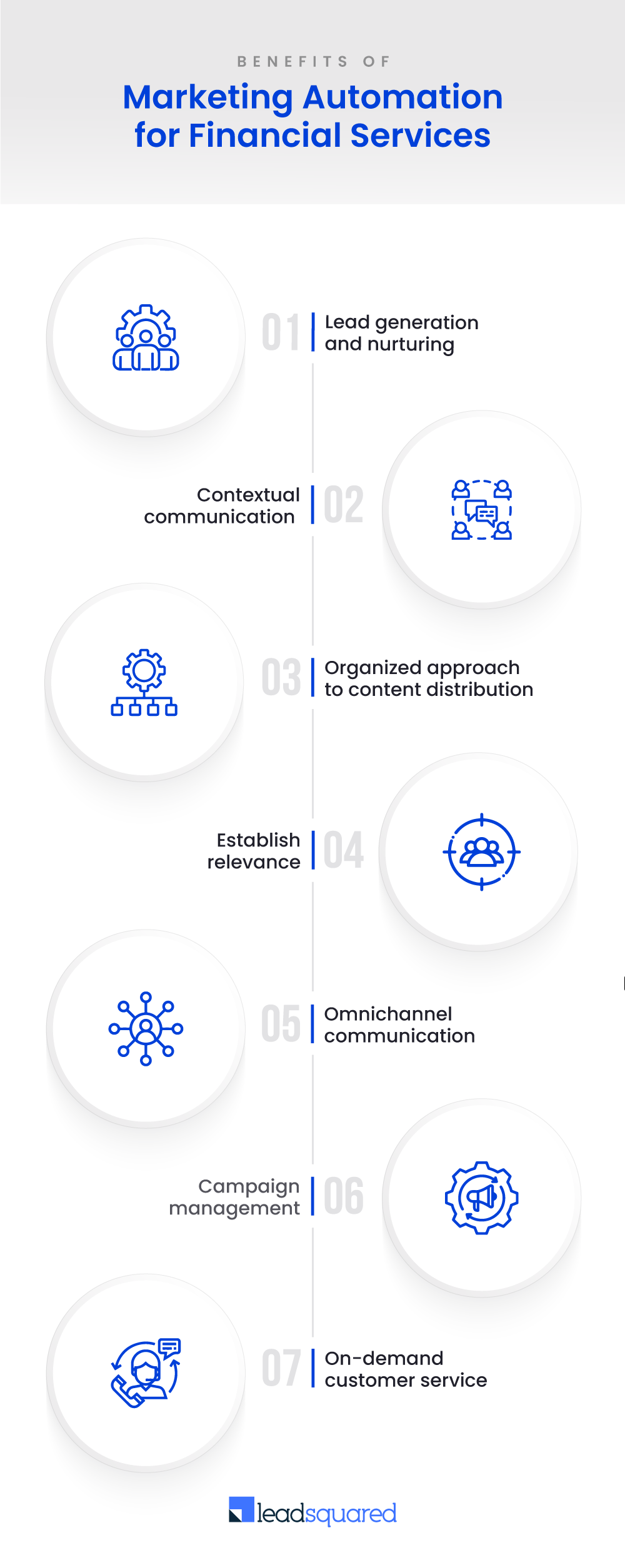

Benefits of Marketing Automation for Financial Services

In the past, after customers made a purchase, their information would be manually added to a list by a customer service executive. The purpose was to schedule a callback, aiming to gather feedback and better understand the customer’s experience with the product or service.

With companies that have implemented marketing automation, emails asking for feedback are automatically sent to retrieve the same information based on the stage of the customer journey.

When this happens at scale, marketing automation can certainly be a boon.

As the feedback mechanism can now run on autopilot, companies can eliminate any manual work in this context and never miss collecting feedback.

Such automations are also a way to engage with customers and incorporate their feedback to establish better processes.

Often, in discussions about marketing, when the focus shifts to driving engagement, people tend to ask:

It’s a question that highlights the importance of actively involving customers and leveraging their input to create more engaging experiences. And to do this marketing automation and its tools can prove to be significantly useful.

Let’s look at some of the top benefits of marketing automation tools to enhance engagement:

1. Manage lead generation and nurturing

This doesn’t mean that a marketing automation tool generates leads single handedly. Marketing automation can help boost your lead generation efforts when valuable content is delivered to prospects across marketing channels.

Coming to lead nurturing, marketing automation can help engage with prospects and customers to ensure customer acquisition and retention.

2. Make communication contextual

The value delivered to prospects and customers can be perceived differently based on their intent and expectations from financial institutions.

For example, a person wanting to start a fixed deposit would seek messages about interest rates more than messages about a credit card.

3. Have an organized approach to content distribution

Marketing automation tools gives greater visibility into data and help make actionable decisions. If there are email campaigns going out for multiple regions, based on data such as open and click rates, the next set of campaigns, their format, and timing can be fine-tuned accordingly.

4. Establish relevance

Ensuring relevance is a great indicator for a customer to feel acknowledged. With marketing automation, ensure that the right message is sent at the right time.

Schedule communication based on every stage of the customer journey. If a customer has a newly opened salary account, an automated welcome message from the designated Relationship Manager with their contact details is exactly what the customer expects to address further queries.

5. Build omnichannel communication

Marketing automation tools help manage communication across channels such as email, social media, WhatsApp, and other platforms.

If there are comments or engagement on a social media post, these tools trigger alerts or notifications to the user.

This way, there are no delayed responses to prospects and customers on channels they prefer to communicate through.

6. Manage campaigns efficiently

Imagine there’s an exclusive credit card a bank has launched with a range of benefits.

A bank can either take a conventional approach and run marketing campaigns in silos or make use of a marketing automation tool to plan, segment, personalize, and schedule campaigns across channels based on customer behavioral patterns.

Isn’t this a sure win from bombarding generic messages?

7. Provide on-demand customer service

Customers earlier had to wait to hear from their service providers if they put in a query.

Today, there are chatbots and other interactive services that allow them to engage with their service providers.

If immediate assistance cannot be given, financial institutions still can send automated messages to customers that they’ve acknowledged their query, and a customer service executive will get back to them shortly.

There are different types of marketing automation tools built for different purposes.

They could be tools for email automation, social media automation, reporting automation, and more.

However, in the next section, take a look at the most common capabilities that companies generally expect from a marketing automation tool.

Understanding Marketing Automation Tools for Financial Services

Marketing automation isn’t just about sending messages and ensuring there’s good brand awareness.

It’s also equally about generating quality engagement with the perfect mix of funnel-driven valuable content with the aim of qualifying prospects.

As pointed out in this article before, in the financial services space, marketing is more about gaining a customer’s trust and loyalty.

And to do that, financial institutions need to align marketing tools based on the volume they operate in, how big of a company they are, and most importantly, what their marketing objectives are.

Nonetheless, here are the capabilities you should look forward to with tools positioned for marketing automation in financial services sector:

1. Landing page creation

Landing pages are focused entry points for visitors, aimed to convert them into leads or customers by providing relevant information and encouraging a specific action, such as filling out a form, making a purchase, or signing up for a newsletter.

Marketing automation tools enable users to creatively design landing pages for any campaign to capture leads and also run A/B tests. These pages can either be created from scratch or by using existing templates.

2. Email marketing automation

Emails are still a thriving marketing channel. According to a study by the American Bankers Association, financial marketers are increasing marketing budgets for emails by 41%.

General setbacks without email marketing automation include inability to view email campaign performance, poor email campaigns with unsegregated recipient lists, emails unoptimized for mobile, and more.

3. Everything social media

Some of the most popular social media marketing platforms for financial services include LinkedIn and Twitter.

However, the use of other social media platforms is on the rise too. With multiple social media accounts, daily posts, polls and other engagement activities, it can be very easy to lose track of their performance and if there are any due responses.

Besides this, these tools also help integrate with other ad platforms like Facebook ads and manage ad campaigns.

4. Integrated campaign management

Whether it’s online or offline platforms you have campaigns going out, maintain a centralized repository of all the information related to them and what your next action plan needs to be.

A single view of all the active campaigns also helps understand where costs can be increased and decreased depending on campaign performance.

Marketing automation tools aren’t limited to just these aspects, they’re often packaged together on one marketing automation suite or are also available as standalone tools.

To make your search for a marketing automation tool easier, take a look at the different options in the market, their features, pricing, and more.

Marketing Automation Tools to Choose From in 2024

Name | Highlights | G2 Rating | Pricing |

LeadSquared |

| Available upon request | |

Act-On |

| Starts at $900/ month | |

Adobe Marketo Engage |

| Custom quote | |

Mailchimp |

| Free version + paid plans starting at $13/ month | |

Insider |

| Custom quote |

Note: The above table is a bird’s eye view of some of the marketing automation tools in the market. Each of these tools are capable of doing a lot more and aren’t restricted to the mentioned capabilities.

In the next section, find out more about how marketing automation can be integrated if you have an existing CRM in place.

Integrating Marketing Automation with CRMs

Having a marketing automation platform that can integrate with other partners and third-party tools is non-negotiable. A marketing automation platform and a CRM share a common goal — to nurture prospect and customer relationships.

Integrating them makes sense because when there are new leads, they can be moved to the sales funnel easily.

This integration also centralizes data and keeps a record of all customer interactions from a sales and marketing perspective to plan upcoming interactions.

A McKinsey report points out that 81% of companies don’t have integrated marketing technology, therefore operating in silos.

How Angel One streamlined processes with LeadSquared

Angel One, a leading stockbroking house in India integrated LeadSquared’s sales execution and marketing automation solutions to address a few business challenges.

Thus included, operating with data in silos, inconsistent sales and marketing experience, lack of personalized communication, and inability to score and prioritize leads accordingly.

By integrating LeadSquared, Angel One engages customers and prospects using personalized content that’s relevant to them.

They now operate on shorter response turnaround times, build prospect and customer journeys with automated marketing initiatives across channels, and promote the chances of conversions.

“The features like activity & automation gave a lot of power to the business team to apply rules on the move without impacting productivity. Smooth integration to telephony systems and real-time reports has helped improve contact center productivity from 30 acc per RM to 180+ acc per RM in the last 2 years. Our acquisition numbers have grown by 10x.”

– Prabhakar Tiwari, Chief Growth Officer, Angel One

As much as the focus is on personalized marketing, or segment-of-one marketing, there’s also a heightened cause for concern around data security. Read on to learn more about how data security and privacy can be established while carrying out marketing initiatives.

Ensuring Data Security and Privacy in the World of Marketing

The financial services industry is a highly regulated one.

To ensure personalization and contextual communication, data is the key. However, as financial institutions, it’s crucial to ensure you meet compliance requirements by taking the right measures to establish information security and privacy.

Here are a few ways to approach this:

1. Capture customer consent

Educate customers about why their data is being collected, where it’s being shared, and how they’ll benefit from it.

Same goes with understanding their preferences, customers have a say in opting in and out of marketing and promotional campaigns.

This way, marketing campaigns aren’t intrusive and are directed only towards prospects or customers who are interested.

2. Security certifications

Ensure that the marketing automation tool or any other tool a financial institution is working with is certified for its authenticity and security.

For example, LeadSquared’s technology solutions are compliant with HIPPA, SOC-2, GDPR, and ISO 27001 certified.

3. Legal requirements

Based on the geography of the financial institution, understand regional laws on how data can be collected, used or shared. Violating these legal compliances can attract high penalties, suspension, and tarnish brand reputation.

4. Data security measures

As a financial institution that holds sensitive financial data of customers, it’s pivotal to implement data security measures like firewalls and data encryption to prevent unadministered access, malware, hackers, phishing attacks, and other such instances.

5. Data protection policies

It’s a good business practice to audit existing data, gate the access of data based on employee roles, restructure data protection policies internally and also educate employees about the importance of adhering to information security requirements.

What’s an article about marketing automation without really addressing how it aligns with today’s top industry trends?

Take a look at this in the next section!

Exploring Revolutionary Trends in Marketing Automation

The biggest buzz on the block is Generative AI with the onset of tools like ChatGPT, Bard, and more.

The future of marketing is hyper-personalized and laser-focused than it already is.

But what are the game-changers that’ll make this possible?

- Imagine campaigns that predict customer desires before they even arise, content crafted in real-time to resonate with individual needs, and automated workflows that adapt to real-time scenarios.

- Machine learning algorithms sift through reams of data, uncovering patterns and crafting tailor-made experiences.

- Chatbots powered by natural language processing offer 24/7 support, building deeper connections.

- Predictive analytics to anticipate customer journeys, optimizing every touchpoint for conversions.

For instance, predictive analytics can help anticipate when and how customers in a category can buy a home. Therefore, helping how the chatbot can be molded to attend to any such upcoming query about mortgages. This also helps with micro-moment marketing. - Emerging technologies like the metaverse blur the lines between physical and digital, creating immersive brand marketing experiences.

This AI-fueled evolution isn’t just about efficiency, it’s about forging emotional bonds with customers, driving loyalty, and boosting ROI. While these are trends that may also be observed in other industries, the financial services space must gear up to embrace the AI revolution and observe how marketing automation can reach its full potential.

The Bottom Line

Marketing automation in financial services isn’t about replacing human interaction and is often seen with this lens. Marketing automation must be seen as a valuable tool to humanize existing processes and the brand itself.

By freeing up resources from routine tasks, automation allows employees to focus on building genuine connections, delivering personalized financial guidance, and most importantly, building a creative approach to marketing.

In today’s fast-paced FinServ industry, where trust and precision are paramount, marketing automation is no longer a luxury, but a necessity. From streamlined onboarding to proactive customer assistance, marketing automation fosters deeper relationships, builds brand loyalty, and ultimately, unlocks the true potential of customer-centric growth. So, take the leap.

FAQs

Marketing automation can benefit financial institutions in the following capacity:

1. Personalization: Tailored content, offers, and communication-based on individual needs and financial goals.

2. Efficiency: Streamlined processes, automated tasks, and saved time for both customers and employees.

3. Compliance: Improved accuracy and adherence to regulations through automated workflows.

4. Customer engagement: Proactive outreach, 24/7 support, and relevant interactions across channels.

5. ROI optimization: Targeted campaigns, data-driven insights, and measurable results for smarter marketing strategies.

Some of the most common use cases of marketing automation tools are:

1. Automated onboarding with personalized welcome messages and account setup guidance.

2. Trigger-based email campaigns for loan pre-approvals, investment recommendations, or financial education tips.

3. Chatbots for 24/7 customer support, account inquiries, and appointment scheduling.

4. Dynamic website content that adapts to user segments and interests.

Security and compliance are top priorities for financial institutions. Reputable marketing automation platforms offer robust security features, data encryption, and adherence to industry regulations to ensure the safety of customer information.

![[webinar] Healthcare-04](https://www.leadsquared.com/wp-content/uploads/2024/02/webinar-Healthcare-04.png)