The African insurance industry is booming, with the market expected to cross $115 billion by 2027. In a race to tap this massive potential, insurance companies are modernizing their sales operations by deploying digital tools and strategies to increase sales efficiency.

To help insurance leaders capitalize on this opportunity, we organized an exclusive webinar on Setting Up Insurance Teams to Overachieve in 2023 with industry expert Chantelle Fraser, Vice President – Africa Sales, LeadSquared to discuss the strategies and tools needed to support their sales reps and overachieve policy sales targets. We also discussed the key trends driving policy sales, reasons why top insurance reps miss their targets, and how automated interventions can enhance agent productivity.

Navigating the Evolving Landscape of the African Insurance Industry

The African insurance market has experienced significant growth in the past two years, with a CAGR of 7.6% and an expected total market size of 115 billion dollars by 2027. This growth has been spurred on by consolidation of operations, rebranding, and technological advancement, as leading insurance firms try to capitalize on the expanding market. To do this, they are modernizing their sales force while adopting digital measures to increase market penetration.

The insurance industry is ever evolving, with changes occurring over the past two years. However, one thing that has remained constant is that people are integral to success. People are and always will be the foundation of any successful insurance organization. And the insurance industries are working on increasing the productivity of their agents by implementing automation. As we look ahead to 2023, we can expect to see further changes in how policies are sold in the industry.

Major trends that will dominate the African Insurance Industry for 2023:

- Hyper personalization of products and interactions

- Increased penetration of insurtech platforms in African countries like Nigeria

- Rise in data-driven decision making

- Increased digitization of every stage in the insurance operations

- More self-service journeys

Insurers are focusing on proactively meeting customer and distributor expectations in a highly competitive market. They are doing so by forming joint ventures with larger sales forces to generate new business and using technology to keep insurers agile, innovative, and customer centric.

A noteworthy example of such collaboration is the Sanlam Allianz joint venture, uniting one of the largest insurers in Africa with a Germany-based giant operating in 170 countries, to create one of the largest non-banking financial services.

They are also taking a comprehensive approach to data management to understand customer needs and drive product and service development. Chief Risk Officers and Chief Technology Officers are playing a more active role in operations by using low-code platforms such as LeadSquared to reduce timelines, risks, and costs.

While navigating the evolving landscape of the African insurance industry, it’s crucial to be aware of the various factors that can bring down sales productivity and take proactive measures to mitigate them.

Factors that Negatively Impact Insurance Sales

As the horizon beckons with some thrilling trends, we also need to take into account the obstacles that may impede us. A few primary issues that affect insurance sales performance are:

- Lack of adequate sales training

As far as training goes on the product side, insurance companies are not short on resources. Indeed, the training material we come across is impressive, but the issue lies in integrating this material to the regular tasks and CRM systems. Consequently, the sales process is not managed in a way that would make the sales agents effective.

- Lack of visibility into incoming inquiries

This problem can occur when inquiries are made through various channels, such as phone, email, and online forms, and there is no central system in place to track and manage them. This can lead to delays in response times, missed opportunities to upsell or cross-sell products, and a poor customer experience.

Additionally, it can make it difficult for insurance companies to analyze customer data and identify trends or patterns that could inform their business strategies. To address this issue, insurance companies can implement a centralized customer relationship management (CRM) system that integrates WhatsApp, phone, email, and SMS.

- Misalignment between involved stakeholders

Misalignment between involved stakeholders, such as customers, representatives, and senior management, can be a significant issue in the insurance industry. This can occur when there is a lack of clear communication and understanding of customer needs and priorities among all parties.

For example, customers may not be fully informed about the products and services offered by the insurance company, representatives may not be adequately trained to handle customer inquiries, and senior management may not be aware of the specific challenges faced by customers or representatives.

This can lead to missed sales opportunities and a lack of trust in the insurance company. To address this issue, insurance companies can implement regular training and communication programs to ensure that all stakeholders have a clear understanding of customer needs and priorities, as well as the products and services offered by the company.

- Decentralized sales resources

A decentralized set of resources in the insurance industry can lead to a decrease in sales productivity, as it can lead to a lack of clear lines of communication and decision-making authority. In a decentralized system, there may be multiple parties involved in the sales process, making it more difficult to coordinate efforts and establish clear goals and targets.

- Low business intelligence to cross-sell and up-sell

Without access to accurate and comprehensive customer data, sales teams are unable to identify opportunities for cross-selling and up-selling, which can limit their ability to grow revenue.

Sales team need to analyze customer data and identify patterns and trends to develop effective sales strategies and target their efforts to the most promising opportunities. Furthermore, business intelligence helps sales teams identify gaps in customers’ coverage and offer additional products that meet their needs.

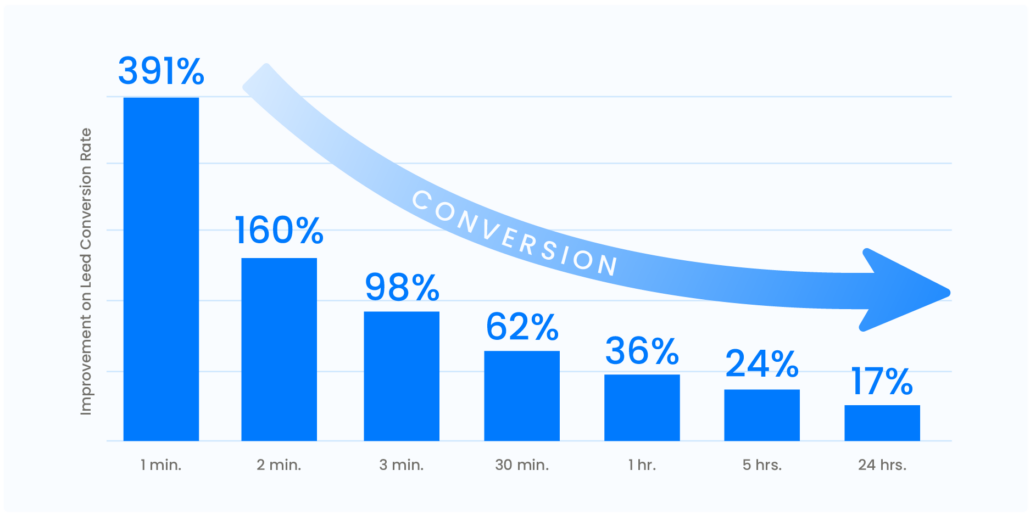

To effectively convey the point that businesses need to respond quickly to inbound leads to increase conversion rates and avoid lost revenue, it’s best to condense the information provided. Recent studies have shown that responding to inbound leads within a minute can increase conversion rates by 391%. However, the average response time is 42 hours, and 23% of leads go unanswered highlighting the need for businesses to improve their lead management and respond promptly.

In today’s competitive insurance landscape, companies need to be brave and take proactive steps to make micro improvements in order to stay ahead. By implementing LeadSquared, insurance companies can manage their leads and keep prospects engaged even if they are not ready to buy. In doing so, they will see their conversion rate increase.

Without sales intelligence, sales agents are not going to be able to do a good job when it comes to upselling and cross-selling because there’s too much activity happening outside the CRM.

Chantelle Fraser, Vice President – Africa Sales, LeadSquared

No matter how much automation you use, it won’t be helpful if the process isn’t up to standard because your CRM and broker ecosystem aren’t connected, leading to frustration for customers and prospects.

Fortunately, it’s easy to fix this problem, so don’t get discouraged!

How to Set Your Team up for Success?

Before we can understand what activities, our sales teams need to do to close a sale, we must first evaluate the efficiency of the current sales process. Do our agents need to make phone calls, and assist customers with applications or should they simply have callbacks during this process? Answering these inquiries will be the key to closing more sales.

In order to get a comprehensive view of your sales teams, break it down step-by-step. By implementing these tips and involving your team in the process, you can create a seamless customer experience, improve conversion rates and increase revenue.

- Comprehend with your team

Every organization is different and will have a diverse range of sales teams with varying needs. It is essential to understand the characteristics of each team, to ensure they are all connected and working together harmoniously. For example, a call center team needs a CRM system to make phone calls, whereas a field sales agent may require an easy-to-use mobile device with offline capabilities. By understanding each team’s needs, you can create a seamless customer experience.

- Understand the sales process

Step two requires you to be knowledgeable about the sales process for each product. By familiarizing yourself with paper-based applications and the underwriting process for products such as life insurance, general insurance, and motor insurance, you can ensure that the sales process runs smoothly.

Grasp the nuances of sales and learn to embrace the journey! The sales process is a pivotal part of the puzzle, so make sure you take the time to understand it.

- Know your product thoroughly

In order to successfully close a sale, it is important for a salesperson to have a thorough knowledge of the product they are selling because it allows them to effectively communicate the value of the product to potential customers, address any concerns or questions they may have, and build credibility and trust with the customer.

A salesperson who has a deep understanding of the product can also tailor their sales approach to meet the specific needs of each customer, leading to more successful sales outcomes and increased customer satisfaction.

Incorporating technology can also help improve sales outcomes. By leveraging technology, organizations can better manage leads, track customer interactions and gain valuable insights.

Increase Sales with Advanced Technology Solutions

Insurance companies face a number of challenges when it comes to implementing technology. These include:

- High costs: Implementing technology can be expensive, and insurance companies may not have the budget to invest in new systems and infrastructure.

- Data security: Insurance companies handle sensitive personal and financial data, and protecting this data from breaches and cyber-attacks is a major concern.

- Regulatory compliance: Insurance companies must comply with a range of regulations when it comes to data privacy, and technology systems must be configured to meet these requirements.

- Lack of integration with existing systems: Insurance companies often have multiple systems in place, and integrating new technology can be difficult and time-consuming.

- Lack of skilled workforce: Insurance companies may not have the internal resources or expertise to implement and maintain new technology systems.

Insurance companies need technology to improve their processes and stay competitive in the market. Here are some of the ways in which implementing technology can benefit insurance businesses:

- Eliminate manual processes: Automate repetitive tasks, such as data entry and claims processing, which can save time and reduce errors.

- Improve customer experience: Self-service portals, online quotes, and digital policy management, which can make it easier for customers to interact with the company and improve their overall experience.

- Increase efficiency and cut additional costs: Insurance companies streamline their processes and reduce costs by automating claims processing and reducing the need for paper-based systems.

- Improve data analytics: Insurance companies collect, store and analyze large amounts of data, which can provide valuable insights into customer behavior and market trends.

- Better fraud detection and prevention: Busineses can detect and prevent fraud by using data analytics and machine learning algorithms to identify patterns and anomalies in claims data.

LeadSquared is a platform that integrates operational data and customer intelligence data to enable sales agents to close sales faster. It also automates the process of nurturing prospects until they are ready to be passed back to the sales agents, presenting them with sales-ready opportunities. This adoption of technology helps to increase sales efficiency and make the best impact on the customer and business.

How Insurance Automation Improves Sales Performance

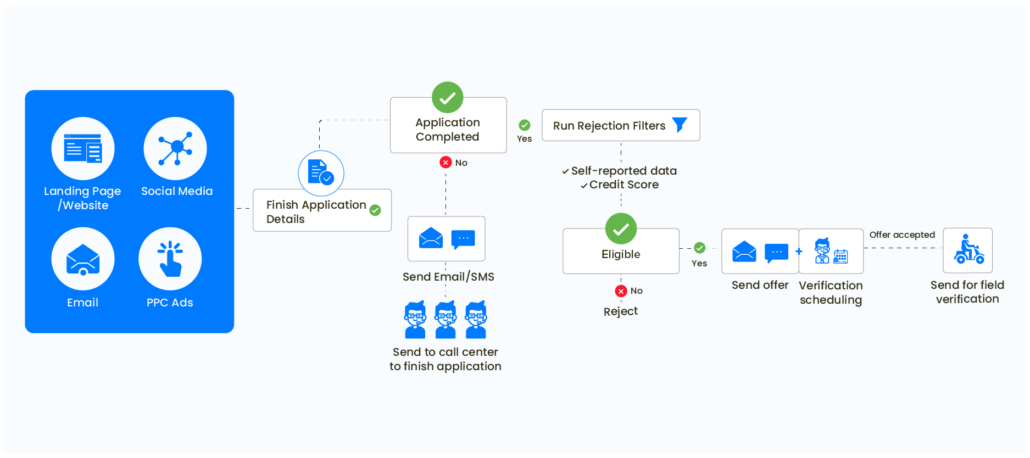

Most insurance companies think they have an impressive level of workflow automation, but they don’t quite comprehend the possibilities. Automation can be a powerful tool in the insurance industry, and here’s an example of what an automated, intelligent workflow could be like.

Let’s take a look!

This diagram may look a little bit overwhelming, but it’s actually pretty simple. Let’s break it down by understanding how automation using a CRM improves each stage of the buying process and ensures that your leads flow through them seamlessly.

- Lead generation can be improved by capturing leads from social media, paid ads, and other digital channels, and then distributing them to your team

- Self-service portals allow customers to start the application process themselves, which ensures that businesses stays open 24/7 and improves the customer experience.

- Customer support can be automated by sending reminders to those who drop off during the process and having call center agents assist customers who need help understanding the insurance jargon.

- Offer generation and task management automation generates offers and creates tasks for field verification teams using integrated CRMs and rules engines.

- Cut down on manual processes as leads flow from one stage to another and make the customer journey more efficient, providing a smoother experience for customers.

- Lead scoring based on the engagement, demographics and interests allows you to prioritize leads for faster conversions.

- Lead routing sends the leads to the right agent based on their skills, experience, and availability, which can improve the overall sales performance.

Create a Winning Environment for Your Team

Creating a winning environment for your team is crucial in achieving success and reaching your goals. A positive and supportive workplace can lead to increased productivity, better teamwork, and improved job satisfaction. Here are some key points to consider when building a winning environment for your team:

Going into 2023, remember that working on culture and the way technology is used in your organization is going to be more and more important. As I mentioned, being a sales professional myself, and also having managed sales teams, you want to focus on creating a winning environment.

Chantelle Fraser, Vice President – Africa Sales, LeadSquared

Mobile CRM solution

Mobile sales agents, field sales reps, and direct selling reps are relied on heavily in Africa to sell products. A mobile CRM application can be used to allow these teams to work in areas with poor connectivity, enabling the business to continue.

LeadSquared offers mobile solutions to reduce fraudulent sales by sales reps and allows businesses to capture prospects information securely. This eliminates the need for manual updates on the system and provides a more accurate impression of the team’s performance.

Improve internal communications

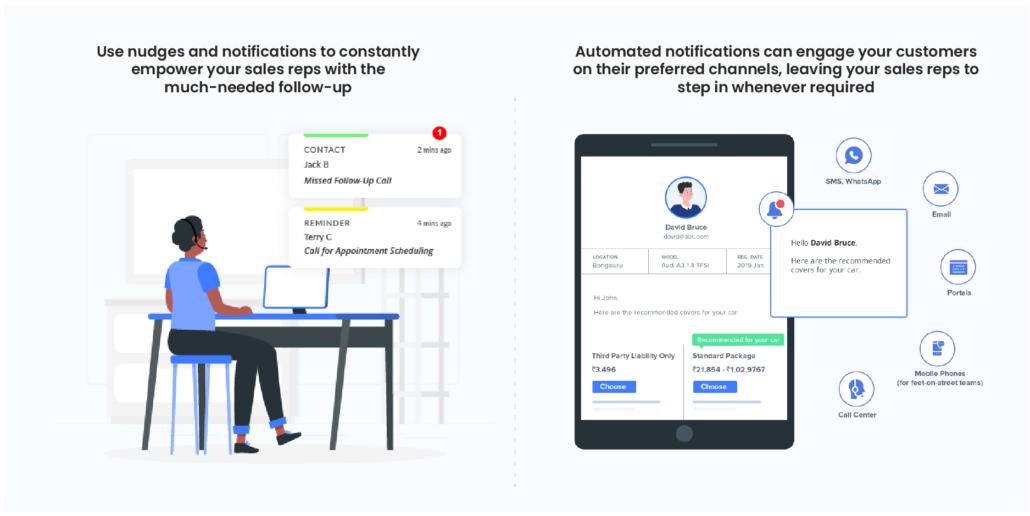

Communication is key for teams and customers. LeadSquared also sends out alerts, notes, and other communication in real-time allowing field sales agents to contact new leads quickly.

Intelligent automation can also be used to present customers with special offers. All of this enables sales teams to do things faster than before.

Sales productivity tracking

Sales managers want to be able to see their performance against targets in real time, as well as the performance of their team, without needing to collate the information manually.

By having all sales processes, products, customer engagement and communication in one place, this information is now available to them and can improve results exponentially.

Sales professionals want technology that simplifies their lives and helps them sell more, so insurance leaders should automate tedious tasks to make sales fun and motivating. To ensure optimal performance, use a CRM or sales execution CRM with a sales performance management suite.

Take Your Insurance Business to the next level with LeadSquared! Our powerful CRM platform helps you capture, track, and nurture leads, measure business performance, automate sales and marketing processes, and analyze customer trends – all in one place.

Get on 15 minutes call with our consultant today!

Implementing a CRM can seem like a daunting task, but it’s worth it for the improved efficiency and increased sales it can bring. By starting with understanding your sales team’s processes and creating a workflow, the implementation process can be streamlined, and can take somewhere between two weeks to four months depending on the complexity. The end result of a fully functioning CRM system will provide a wealth of benefits for your business.

As a salesperson, being available and accessible is key for success in this competitive world. It’s all about adding value, and seeing where one can be of assistance. These policies and mantras help to ensure that they finish the year on a high note and make sure that the sales team meets the company’s goals.

Speaker

Chantelle Fraser

Vice President – Africa Sales, LeadSquared