Debt collection is all about efficiency. Any loss in resources, any extra expenditure, or delay in the EMI collection – can pose a real challenge for creditors.

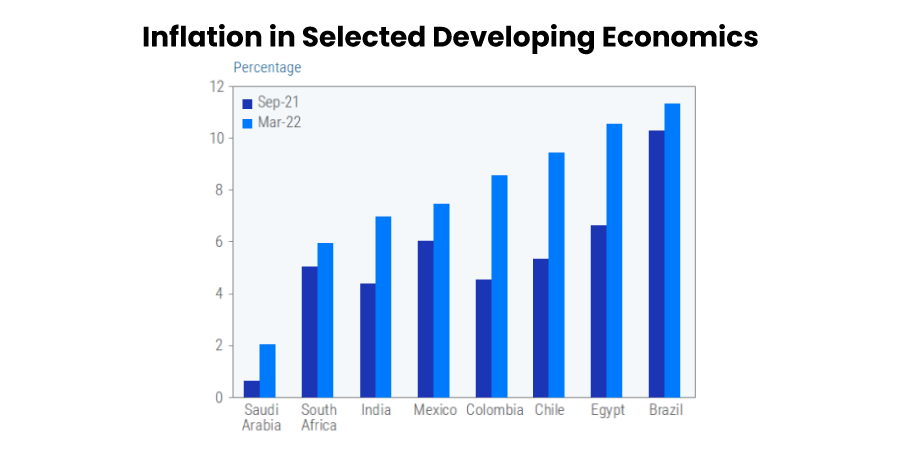

Currently the world is going through an inflationary period. And to combat inflation in their countries, banks are increasing their interest rates. These two factors are weighing down on the customer and contributing to a rise in need for additional credit.

Simultaneously, factors like rising income, better financial understanding, and better reach of financial products, also contribute to higher levels of credit demand. And while growing household debt is considered as a positive sign for world economies in the short term, in the long term, it can be a sign of the declining economic prosperity of a nation.

In the end, the average credit consumer credit may find it difficult to repay their EMIs. Hence, most creditors must be on their toes to avoid rising Non-Performing Assets or NPAs and achieve stable growth rates.

To achieve this, creditors must embrace digital solutions to improve their collection efficiency.

In this article, we’ll discuss the following:

- What a typical debt collection process looks like?

- Challenges in existing debt collection processes

- What is collection efficiency, and how does inefficiency impact you?

- Tips for leveraging automation and maximising recovery

What is debt collection?

A debt or EMI collection is the process of recovering loan instalments from borrowers.

Creditworthy borrowers often repay their loans timely. But there are instances where borrowers cannot pay their EMI on time.

Reasons may include:

- Lack of awareness about when to pay

- Liquidity crunch due to job loss or family emergency

- High EMI instalment amounts leading to irregular repayments.

- Lack of payment methods that the borrower is comfortable with.

Several reasons can contribute to missed payments. And here’s where your collections process kicks in. Depending on the customer’s Days Past Due Count or DPD count and Promise to Pay Date or PTP date, creditors can limit recovery actions to reminders over chat/email or extend it to an in-person visit.

Since debt collection is a resource-intensive process, improving efficiency must be the primary motivator for any creditor while designing their recovery process.

In the next section, we’ll discuss the prevailing collection process related challenges.

Reasons why creditors suffer from low collection efficiency

Any lending/banking business can choose to recover the debt in primarily two ways:

- Inhouse debt collection team

- Outsourced collection agency

These 5 points can contribute the most to low collection efficiency in both cases.

Let’s take a deeper look at each problem statement.

Manual case management

When we say manual case management – we mean collection processes with little to no digitization/automation.

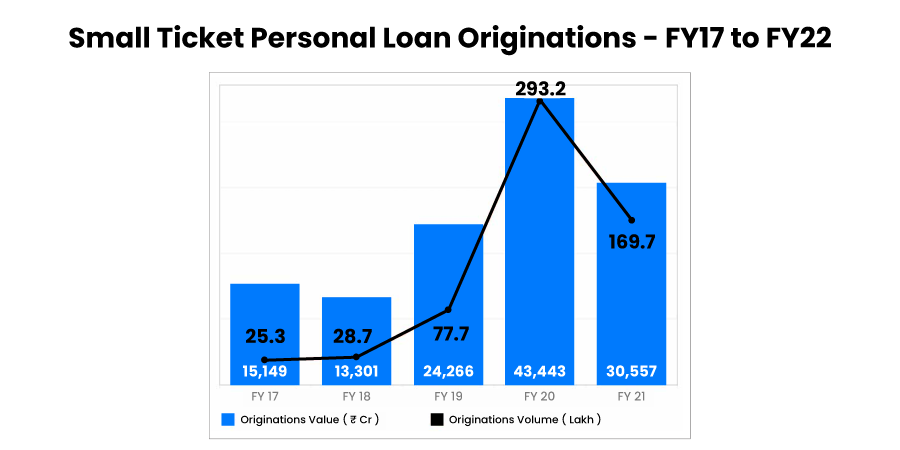

A study by CRIF Highmark from 2021 shows that post-covid, the demand for small-ticket personal loans has increased exponentially in India.

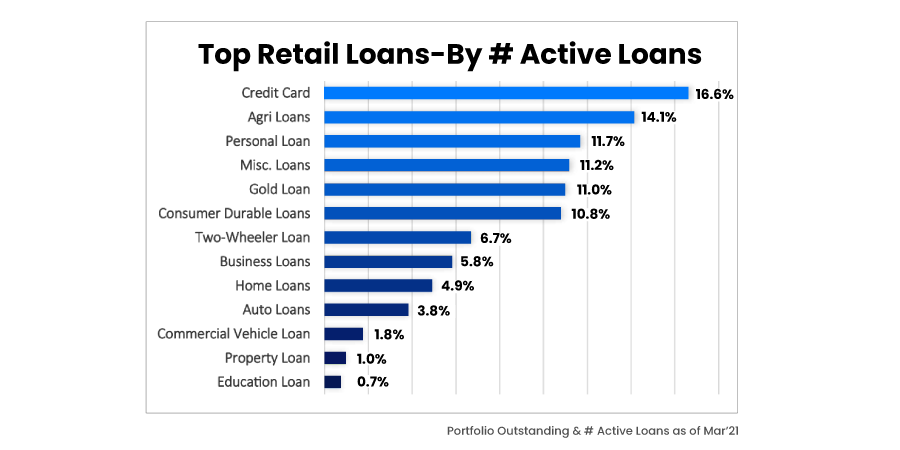

The report also highlights the contribution of credit card, personal, and consumer durable loans at roughly 42% of total active retail loans in India on March 2021.

The credit demand in Asia is set to snowball by 2030. Similarly, other geographies will experience the same. And as internet penetration increases, leading to ease of accessibility, we can expect further growth of small ticket loans.

What does this mean for collectors?

These are small-ticket, unsecured loan products with shorter borrowing periods, meaning creditors must expect higher loan delinquency rates in shorter timelines. And while the interest margins will be higher in this segment, more collection efforts will be required, reducing net profit margins gained by creditors.

Manual efforts will just not cut it. It will overloading teams with cases and hence falling short on their collection rates. In the long term, it can lead to a significant drop in collection efficiency.

Low/no intelligence on cases susceptible to delinquency

Post-origination, new loans are usually managed through the Loan Management System (LMS). Before, creditors worked these loans over sheets and excel, but now most have moved on to sophisticated systems.

One problem with loan management systems is the lack of insights about which loans may be prone to delinquency. Top creditors are already analysing customer behaviour or payment patterns through many touchpoints to gauge which loans in their portfolio may go delinquent or even default.

Many creditors need this granularity. However, since these details aren’t there, collection agents end up calling the wrong prospects and can damage their chances of generating new cross-sell/up-sell opportunities.

Hence, a lack of case prioritization can also bring down your debt collection efficiency.

Low productivity of collection reps

Debt collection is a challenging process. Firstly, by nature, it is laborious and sometimes violent for the reps. For instance, many reps must visit remote locations daily in-order to process hard collections. This can be taxing for the reps because despite the efforts put in, the probability of meeting the borrower and getting the recovery amount is very less.

Additionally, customers also evade EMI payment due to reasons like liquidity crunch, leading to more investment of resources in recovery. Overall, this creates a lot of burden on both the reps and the customers.

Secondly, reps can find themselves without clarity on their process/targets. This contributes to loss of time, energy, and efficiency – something most creditors cannot afford.

Isolated teams and systems

Another important factor contributing to low collections efficiency is a fragmented process. When reps cannot communicate with each other, exchange/access data seamlessly, view the lifecycle of cases, the process becomes unscalable.

- Interactive Voice Response tool

- The chatbot/WhatsApp messenger

- Debt collection software

- LMS (also has debt collection capabilities)

- The payment applications/channels

- Receipt generation & management tools

- Legal case management software

Integration between these tools is necessary to ensure consistent and bidirectional flow of data. If not done properly, it reduces the overall debt collection efficiency.

Ill-timed communication and efforts for the collection

Mistimed collection efforts can significantly worsen customer experience and push them toward your competition. According to one survey by PwC, 32% of customers would discontinue using the service of a brand they have been loyal to after just one bad experience.

New-age automation platforms like LeadSquared can help creditors avoid this problem by fetching the exact DPD/PTP date and scheduling reminders for repayment. For instance, instead of calling up the borrower, automated payment reminder notification before the DPD on WhatsApp could help.

Tips to improve your debt collection efficiency

At LeadSquared, we have observed that eliminating these challenges can improve collections efficiency by up to 22%. Here’s how.

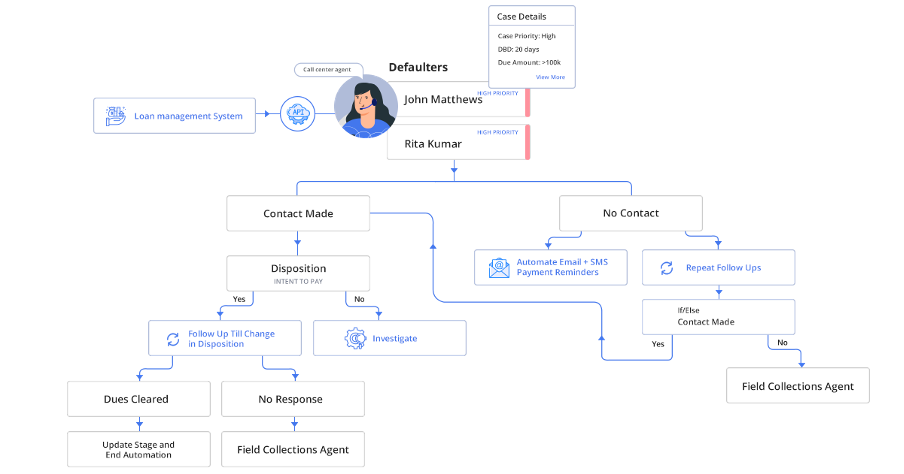

Build end-to-end case management workflows

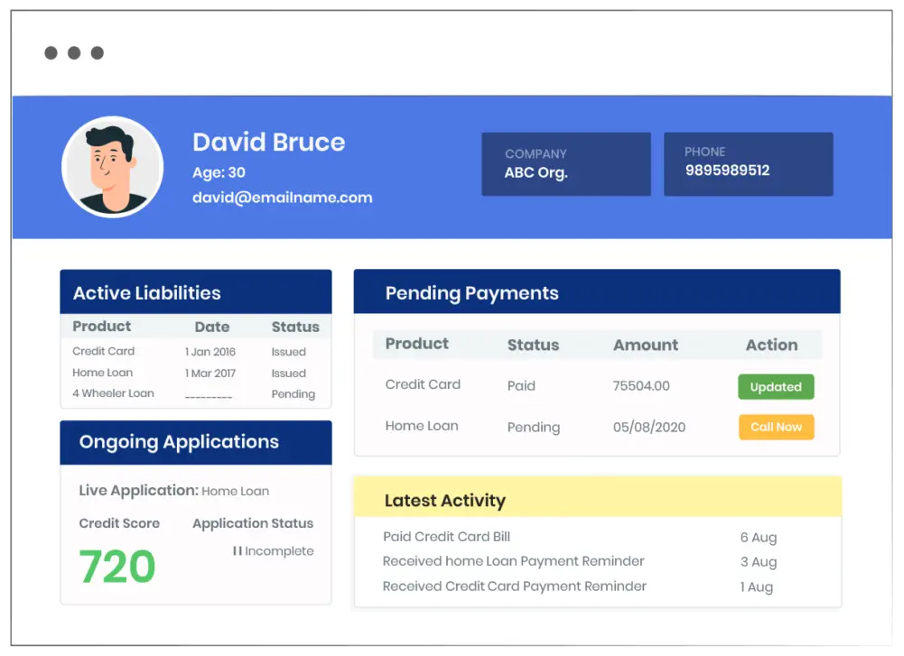

Creditors can integrate their LMS with Lending CRM and import all new delinquencies directly. At the same time, many collection CRM solutions, like LeadSquared, allow creditors to import cases through CSV files in batches. It helps creditors keep track of each case and manage them seamlessly.

The benefit of a collection CRM solution is manifold since it also helps managers through a granular view of every case’s stages. It also helps track where cases are piling, preventing further backlogs and enabling a proactive approach to improve your debt collection efficiency.

Automatically segment customers and derive real-time insights

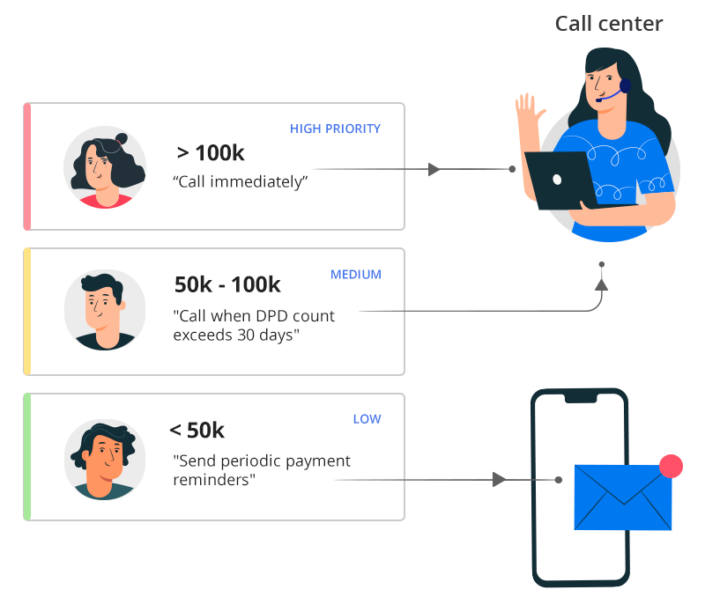

Many collection management platforms have an inbuilt DPD/PTP counter for each case file. Creditors can also leverage automation workflows to segment cases into different buckets and tackle them accordingly.

For instance, cases with a DPD count between 15-30 days can receive regular emails/WhatsApp messages. If the count becomes 30+, creditors can deploy soft collection methods like calling. In cases where the borrower has given a PTP date, a task/activity can be set for follow-up through regular SMS.

Creditors can also assign scores to borrower actions such as partial or missed payments. In such instances, automation workflow can be designed to take corrective actions.

Also, deploying hierarchy-based views will bring more transparency at each level, better alignment between stakeholders, and help improve efficiency.

For instance, creating highly specialised dashlets for:

- Reps

- Managers

- Senior Management

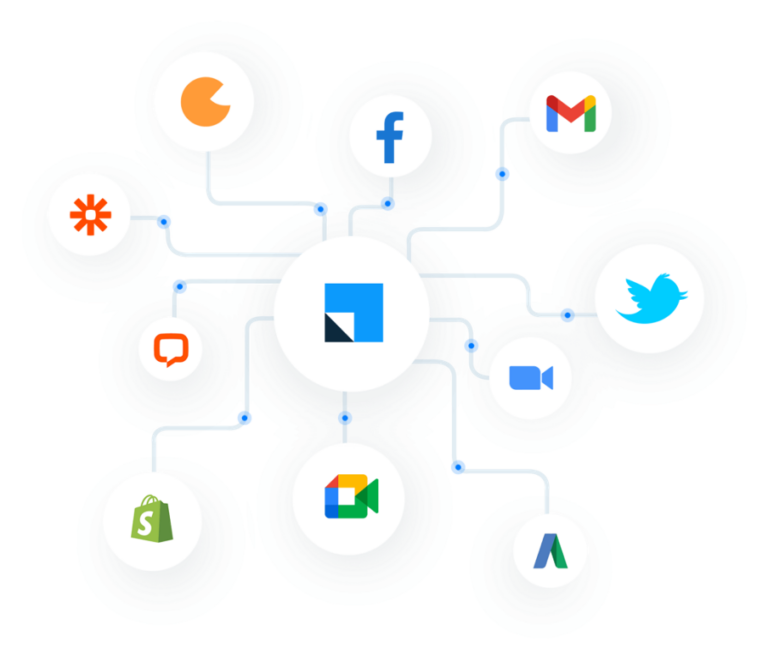

Develop an integrated ecosystem of applications

By aligning different tools required to pursue delinquencies, creditors can improve their debt collection efficiency.

For instance, LeadSquared CRM offers custom integrations and many out-of-the-box connectors for IVR, chat, social, etc.

If a borrower prefers to communicate via WhatsApp, the rep can get directly notified in their dashboard and reply from the same window. Additionally, you can integrate with various payment applications/self-serve portals to facilitate cashless/paperless transactions.

By integrating different systems, you can make it easier for collection agents to pursue cases.

Prioritize cases & actions for the reps

Debt collection CRM platform can help improve your reps’ productivity. LeadSquared serves as a central platform for all collection activities. Both soft and hard collection reps can chat, call, follow up, and collect repayments through the platform.

Additionally, creditors can create daily plans for reps to follow. Managers can segment cases based on factors like DPD and PTP numbers and assign to the reps for follow-ups.

Here’s an example.

ORIX Leasing and Financial Services (OLFS) uses LeadSquared to make their collection agents more efficient. Using features like the daily plan, geo-tracking, and geofencing in the LeadSquared Collections app, OLFS managers could bring down their conveyance spending while improving the number of field collection trips.

At the same time, timely nudges and automated notifications via the app can eliminate missed follow-ups and streamline the case pipeline, preserving bandwidth and increasing collection efficiency.

Summary

The growing credit demand is foreseen. While it sounds good for the lending sector, it will also contribute to a rise in unpaid debt.

To tackle this problem, creditors must invest in process automation and scalable lending solutions. It will help them:

- Bring down the steps required for reps/borrowers to achieve repayment.

- Optimize spending on resources.

- Contribute to improved customer experience.

- Cut collection timelines.

If you are a creditor/collector looking to optimise your debt collection efficiency, check out the LeadSquared debt collection CRM. It can help increase your loan recovery by up to 22%.