The world has gone remote, and businesses had to close their physical stores almost overnight. A change of this scale was completely unprecedented even by the most seasoned futurist. Everyone, including employers and employees, has had to remodify how they work and quickly adopt new ways of staying productive.

Things are not significantly different for the lending industry. To survive in this new world, lenders must adapt to technology quickly. Lending FinTech has always been around, but adoption rates were prolonged. But, post-COVID-19, lenders are hailing digital platforms as their messiah, who could save them from getting lost in this uncertainty. This article attempts to look at all the tools out there that could help your lending services sail through these turbulent times.

Digital Transformation in the COVID era

Financial institutions worldwide had to close most of their physical locations and encourage their customer base to adopt remote practices. What worked before for lending fintech does not hold anymore. So, lending houses are quickly adapting to this change. Here are some exciting trends in the way people are handling their finance.

- 35% of customers have increased their online banking usage

- Visa saw more than 13 million customers in Latin America make their first online transaction

- Mastercard has reported more than 40% growth in contactless transactions globally

(Source: Deloitte)

In the US, the adoption of automation tools and other tools have seen a rapid increase across multiple industries, with banking at the forefront.

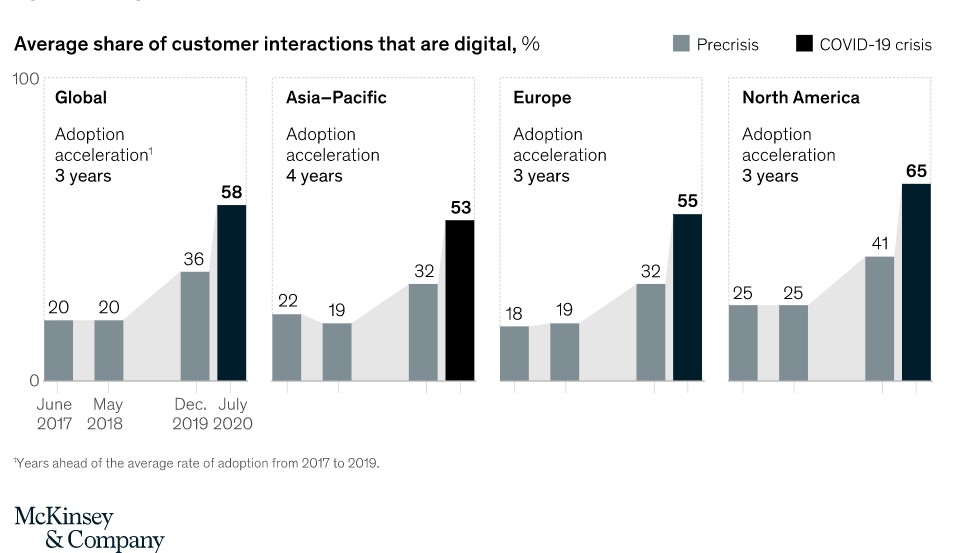

William Demchak, CEO, PNC Bank, notes that bank sales have jumped from 25% digital to 75% digital during COVID, shrinking ten years’ worth of changes into one year.

And this sudden scramble to go digital is not a short-term effort. Most businesses recognize the benefits of automating their various processes and their effect on their costs, productivity, and efficiency. Lending Fintech companies intend to keep this going even after things return to normal.

The Best Tools for Lending Fintech Businesses

When thinking about going digital, your lending firm should not be thinking only about automating the loan disbursal process. There is a myriad combination of functions and procedures that need automation as well. Right from identifying new target markets, procuring new borrowers to loan origination, risk assessment, underwriting, and debt collection, you need tools that can help you expedite your loan disbursal process. And automation does not just stop there; it also applies to managing your employees – including hiring, paying, and retaining them, and now, giving them the tools to work remotely.

Let us take a quick look at all the different tools you’d need and how they can increase your productivity and efficiency.

Employee Management Software

Human resources are probably the most important investment a company makes. The biggest mistake that most organizations make is ignoring their employees and any grievances that they may have. Having an HR team that does not actively address employee issues will only lead to increased attrition and affect your internal processes’ efficiency. The following are some famous people management tools.

- HRMS (Human Resource Management System) – Epicor, Oracle HCM, Workday, Bamboo HR

- Payroll software – QuickBooks, Sage Payroll, Xero, Paylocity, Ceridian

- Employee engagement software – Culture Amp, Office vibe, 15Five, Energage, Impraise

- Employee expense reimbursement software – Expensify, Fyle, Concur, Chromriver, Certify

But it does not stop there. Even in the post-pandemic world, the trend of remote work is going to continue. Therefore, you need to prepare your people to adapt to this new situation. There is a ton of productivity tools in the market. Here are some of the must-haves:

- Video conferencing tools – Zoom, Google Meet, Skype, GoToMeeting

- Online collaboration tools – Slack, Microsoft Teams, Notion, ClickUp, Asana, WebEx

- Cloud storage solutions – Dropbox, OneDrive, iCloud, Google Drive, Sync.com

Lead Sourcing and Management Software

Before you can disburse loans to people, you need to identify who these people are. In today’s competitive world, hoping potential borrowers would come to you out of thin air is merely short-sighted. There is a world of tools out there that can help you identify where your borrowers are and to help you reach them effectively.

However, you also need to be where they are and speak the language they speak. The message you send should focus on being helpful without being sales-y. Especially with a high-risk product like a loan, cultivating trust is essential. Here are some tools that you can use to attract new leads.

- Paid marketing channels – Google AdWords, Facebook, LinkedIn

- Marketing automation tools – LeadSquared, HubSpot, InfusionSoft, Marketo, Pardot

- Email marketing software – MailChimp, LeadSquared, Customer.io, Sendgrid

- Social media automation – HootSuite, Buffer, Mention, Sprout Social

- Marketing analytics tools – Google Analytics, SEMrush, Ahrefs, BuzzSumo, Hotjar, Spyfu

Once you bring in a steady stream of interested borrowers, the next step is to push them to complete their loan application process with you. You need to understand where your leads are in the funnel and what you need to do to give them the right nudge. Analyzing patterns from historical data is one of the best ways to do this. But trying to do this manually is a nightmare. Turn to the software that can help you do this instead – the lending CRM. Here are some popular choices:

- LeadSquared

- Velocify LoanEngage

- Unify CRM

- Whiteboard

- bnTouch

Loan Lifecycle Management Software

Now comes the star of your lending institution – the loan disbursement process. Despite the lending industry showing some resistance to going digital, there has been a significant boost in the number of products that promise to bring automation to lending. Even before the pandemic made it a necessity, these tools were still gaining popularity, thanks to their promises of getting more work done with lesser effort, and faster results.

One main reason lenders were reluctant to adopt digital practices was because they dealt with sensitive and volatile financial information. The risk and damages of potential data breaches could be devastating for the business. However, with more cloud solutions that come with data security layers, including, but not limited to, IP restrictions, password encryptions, SSO services, and more, the fear is somewhat alleviated. Some popular loan management solutions are:

- Loan origination software – Encompass, Calyx Point, LendingPad, Nortridge

- Lending CRM software – LeadSquared

- Loan servicing software – TurnKey Lender, LoanPro, Finflux

- Collateral management tools – Calypso, Broadridge, Murex

- Credit risk management tools – Matlab, Actico, ViClarity

Customer-facing Software

There is a massive influx of customer queries that come into lending houses after the pandemic hit. With increased unemployment, a lot more borrowers are unable to pay back mortgages. According to Euler Holmes, US commercial and industrial loans’ delinquency rates are to reach a record high of 6.5%, the highest since 1992.

Although the situation looks bleak, lenders try to keep afloat by being there for their panicked and worried borrowers. Many of them are having to train existing staff to handle customer queries or set up emergency call centers to deal with the situation. Here are some tools that will help you be better prepared to face and resolve customer queries

- Call center management software – Zendesk, Freshcaller, Ringcentral, Dialpad

- Customer service software – HubSpot, Zohodesk, Freshdesk

- Live chat tools – Olark, ChatBot, LiveChat, Intercom, Drift

To further enhance the user experience and improve your team’s productivity, you can integrate these solutions with your CRM software. For instance, LeadSquared Lending CRM seamlessly integrates with several telephony and cloud-calling software.

[Also read: latest consumer lending trends]

Conclusion

As a progressive lending business, you cannot shy away from or resist adopting new technology. Digital transformation is not a fad that you can ignore. It is here to stay – long-term. Unless you jump on the bandwagon, you might be left behind. Now with the pandemic keeping your customers home, the need is more urgent than ever.

An even more compelling argument is your customer. Borrowers are increasingly aware of the market’s enormity and do not have the patience to deal with a lender who doesn’t give them a quick, hassle-free, and smooth loan application process.

It is easy to get confused with the number of software out there. Choosing the best software for your business is not going to be easy. But here are some steps you can follow to simplify the process:

- Identify your most significant pain point

- Go online or talk to your peers to find solutions

- Shortlist at least five software that solves your problem

- Request online demos

- Read reviews on platforms such as G2, Capterra, or Software Advice

To start your digital transformation journey, you must try LeadSquared Lending CRM software. It has helped lending firms like ORIX, Auxilo, Lendingkart, InCred, and many more in reducing their loan disbursal times while increasing the overall operational efficiency.

Lending FinTech FAQs

Short for Financial technology, FinTech lending businesses employ technological solutions such as artificial intelligence, machine learning, mobile computing, and more to enable borrowers to access funding.

According to Investopedia, the top 10 FinTech companies are:

1. Ant Financial

2. Adyen

3. Qudian

4. Xero

5. SoFi

6. Lufax

7. Avant

8. ZhongAn

9. Klarna

10. Oscar

Yes, any company that offers an online financial solution with the help of technology can be considered a FinTech company.