The financial industry continues to evolve to accommodate the shifting trends in the consumer lending sector.

Consumer lending has been increasingly in demand as individuals struggle to cope with the pandemic. According to data from TransUnion:

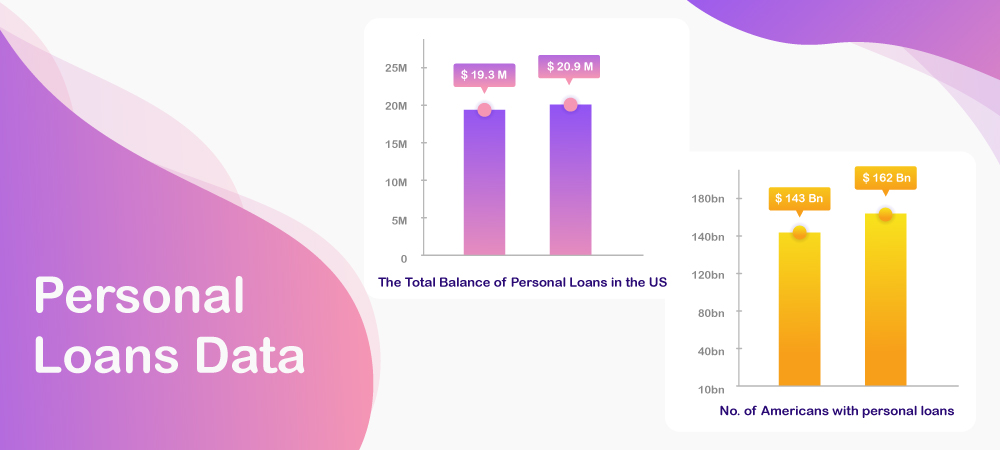

- The number of Americans with personal loans increased from 19.3 million to 20.9 million.

- The average amount of personal loan debt per borrower increased from $8,618 to $9,025.

- The total balance of personal loans in the U.S. increased from $143 billion to $162 billion.

The increasing number of borrowers is making it difficult to identify individuals qualified for loans. The issue of unemployment also contributes to this problem, with several borrowers lacking collateral for their loans. This brings us to the first consumer lending trend foreseen for 2024:

1. The search for lower-risk customers

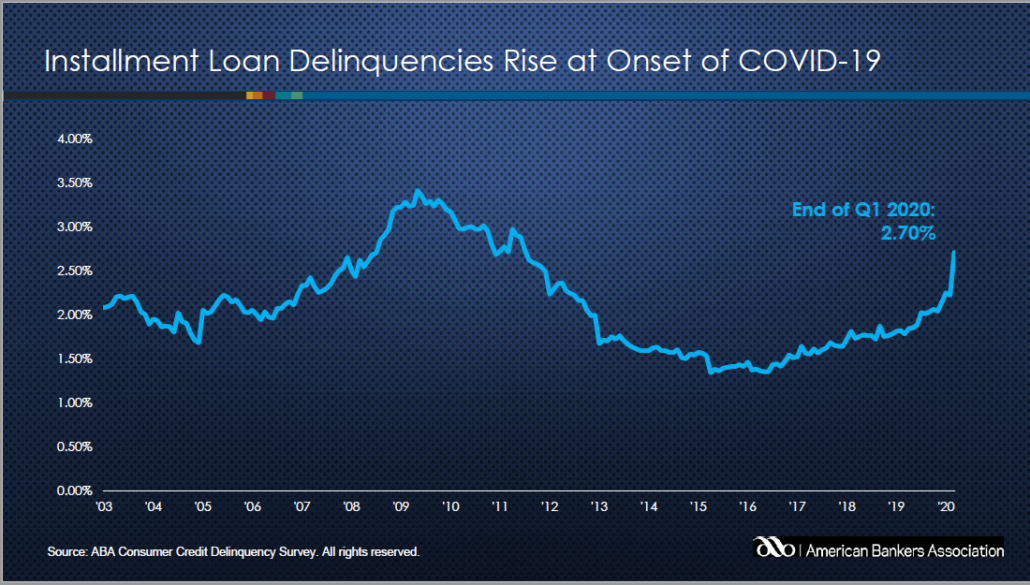

The previous years had a highly negative impact on delinquency rates due to rampant unemployment. Consumer credit delinquencies rose in all 11 closed-end loan categories in the first quarter of 2020. The composite ratio, which tracks delinquencies in eight closed-end instalment loan categories, rose 56 basis points to 2.70 percent.

Credit: American Bankers Association Report

This increase in delinquency rates is especially noticeable in consumer lending. Home equity loan delinquencies rose 47 basis points to 3.58 percent of all accounts. Property improvement loan delinquencies rose 10 basis points to 1.64 percent of all accounts.

According to a report by Defi Solutions, delinquency rates will continue to rise throughout 2021.The remedy for these ever-increasing delinquency rates lies in the search for low-risk consumers. In a report by the GlobeNewsWire they found that Auto loans are the prime consumer lending products. Auto loans also have lower delinquency rates, as reported by Transunion. They state that most people continue to repay Auto loans despite existing crises.

Increasing levels of employment are expected during 2021, which will help encourage customers to repay their loans. Banks are looking for customers who will be regular in their loan repayments to foster overall recovery. Lenders can achieve this by creating highly structured online application forms to vet unqualified borrowers. Financial institutions need to incorporate these systems of detailed identification to rapidly recover in 2024.

2. The push for auto loans

Auto loans remain a source of stability, specifically in terms of fostering recovery in the consumer lending industry. During the second quarter of 2020, auto lenders saw a deterioration in performance. For instance, Borrower-Level Delinquency Rates increased to 1.50% from the previous 1.23% (Source). The setbacks in auto loans are not seen as detrimental to the lending industry. Most consumers tend to repay auto loans even during times of financial crises. The deterioration is due to the reduced cash-flow rather than consumer reluctance to make payments.

Despite the initial high delinquency rates, a report by KASASA states that auto loans remain a reliable source of qualified borrowers, which they attribute to borrowers capitalizing on captive financing options. Automotive manufacturers such as Ford offer 0% financial deals, making it all the more appealing for consumers.

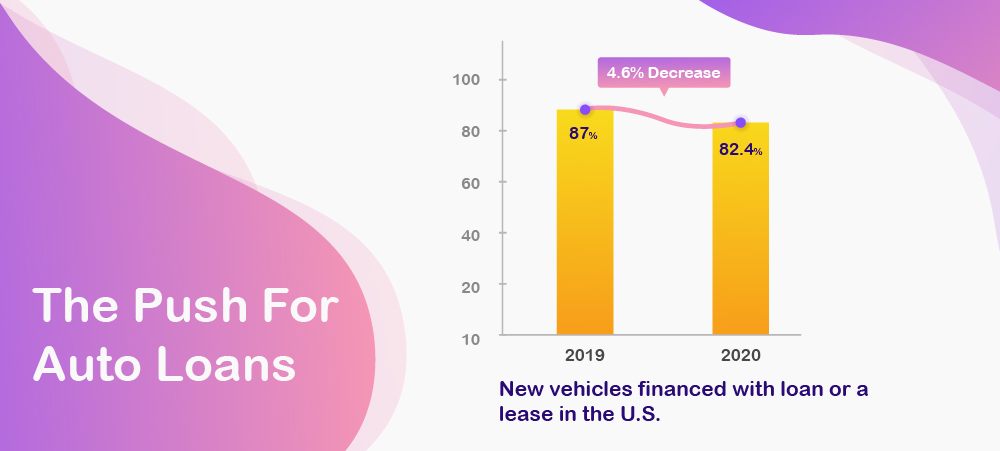

In the third quarter of 2020, 82.4% of new vehicles were financed with either a loan or a lease in the U.S. The statistics for 2019 stand at 87%, showing a decrease of 4.6% during 2020 according to the Financial Brand. Consumers have also shown that they would rather purchase used cars than have no car at all. The presentation shows that almost 47.8% of the consumers have bought used vehicles during 2020. This trend in automobile purchasing will continue to rise. As Auto loans continue to be in demand, it gives financial institutions the liberty to qualify lower-risk consumers. It is thus making the process for recovery within the consumer lending sphere possible in the next few months.

(Source: https://www.experian.com/content/dam/marketing/na/automotive/quarterly-webinars/credit-trends/q3-2020-safm.pdf)

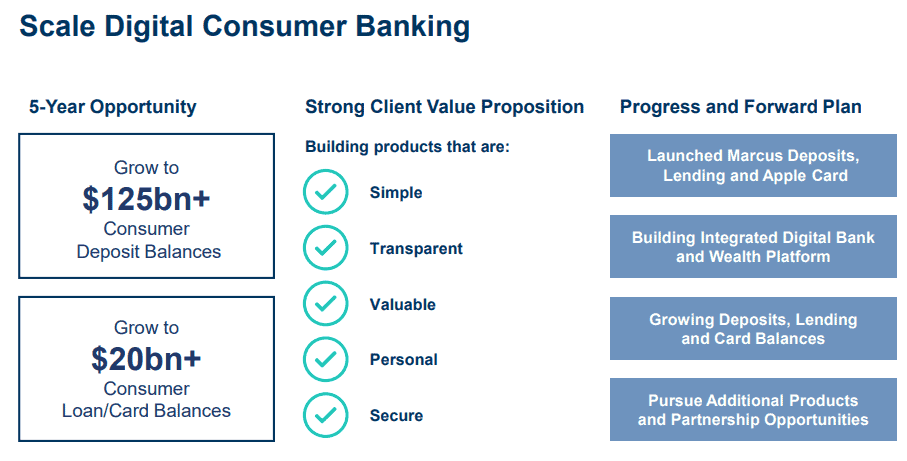

3. Diversifying the lending landscape

In 2020 Goldman Sachs collaborated with Amazon and Apple, both of which are hailed as upcoming nonbanks. Goldman Sachs was in talks to offer small business loans to merchants on Amazon. Goldman Sachs is currently melding its digital underwriting services using its technology. They officially launched Marcus in 2016. Marcus by Goldman Sachs is an online-only bank offering savings accounts, penalty-free certificates of deposit, and no-fee personal loans. It is now part of the collaboration as it was previously a completely digital financial platform. The bank has been working on software that will be plugged into Amazon’s lending platform.

Credit: ZDNet

Amazon itself possesses a lending platform for sellers, having loaned 1 Billion USD to small businesses. The features of their platform are being integrated into Goldman Sachs’s Marcus Project. Amazon’s success is largely due to its hyper-personalized marketing. The Amazon algorithm recognizes members who require loans and targets products accordingly. This feature is likely to benefit the future digital lending platforms as well.

The Apple Card is a credit card created by Apple Inc. and issued by Goldman Sachs in 2019. It is designed to be used with Apple Pay on Apple devices. With the Apple Card, Goldman Sachs has lent out about $10 billion in credit (Source). Goldman Sachs will be the back-end provider of Apple’s bank-regulated services. The Marcus Project plans on covering spending, saving, and borrowing into the newly integrated platform. The introduction of such nonbanks into the lending sphere may bring intense competition to traditional lenders. A Forbes article states that nonbanks will be one of the many upcoming innovations in the consumer lending industry.

4. Forbearance and Hyper-Personalization

According to TransUnion 2021 consumer credit forecast, forbearance will remain flat for the first quarter of 2021. It ties in with a decline in mortgage accounts in forbearance expected during April and May. When mortgages are in forbearance they are not viewed as delinquent. This results in severe losses in lowered loan repayments, leading to intensely low delinquency rates when these programs are discarded. The pandemic saw a rise in forbearance. According to Deloitte, the remedy for recovery is hyper-personalization. An immediate solution is chatbots and AI as they can deliver highly personalized customer experiences and learn from customer interactions.

Also, 76% of Americans are more likely to purchase products when organizations provide personalized consumer experiences. Gen Z echoes similar sentiments as 28% of them are more likely to purchase personalized products. The next few years will see Gen Z as the largest number of consumer loan borrowers. It is vital to customize borrower experiences according to their needs to compete in a digitally advancing market. According to Deloitte, personalization enhances the feeling of the human touch in mundane financial procedures. Personalized marketing of lending services enhances the customer experience by reaching out to leads at the time of need. When paired with lead scoring to reduce delinquency, personalized marketing can improve consumer lending on the whole.

5. The incorporation of ML, AI, and Data Analytics

During the pandemic, the finance sector deeply realized the need to implement AI and data analytics in their business procedures. Artificial Intelligence is changing how we interact with money. Several institutions are already experiencing great success with this technology. ZestFinance is one such Machine Learning platform that enables lenders to make better lending decisions by providing a more accurate picture of borrowers. Using machine learning-based underwriting to predict risks, auto lenders have reduced losses by over 25%.

The company has also collaborated with Ford Motor Credit Company, where they studied the relevance of artificial intelligence in auto financing. After analyzing the results, Ford Motor decided to integrate ZestFinance’s AI systems into their organization. Personetics, a cognitive banking organization, is another example of AI-based banking. They use a Machine Learning system to help individuals pay off their student loans faster. Their system uses machine learning to analyze financial habits and determine if they can afford to pay back their student loans quickly. The finance sector is working to implement such AI and ML solutions into their organization.

The Business Insider found that financial institutions are working to implement AI and ML solutions in risk management and customer service. The incorporation of Artificial Intelligence is not only for greater efficiency but also to reduce biases in lending. Harvard Business Review details the issues involving discriminatory biases that come into play during lending. One lender found that women have to earn 30% more than men on average for equivalent-sized loans to be approved. The right AI-driven model can close the mathematical gap of how similar people from different groups are treated differently by 20%. AI gives highly personalized predictions of consumer needs while decreasing discrimination. These innovations can enhance the inclusivity of financial institutions and lending platforms.

The bottom line

Consumer lending trends develop in accordance with the latest innovations and technology. Sustainable financial goals are gaining worldwide recognition due to increasing globalization of our economies. Data analytics and greater personalization will change the way financial procedures function globally. Personalized marketing is essential to keep up with evolving financial trends. Data analytics and reports are necessary for future marketing campaigns and help boost cross selling opportunities.

Finding qualified borrowers and generating leads who foster debt recovery are essential to tackle the trials of 2021 and 2022. Reducing delinquency rates while increasing the number of qualified borrowers is key to achieving success in 2024. If you’re interested in gaining more information about generating leads who are qualified and increasing cross selling opportunities. Do check out LeadSquared’s eBook !

Also read: