There is no sugarcoating it. The unprecedented pandemic has changed the world in ways we couldn’t have imagined in our wildest dreams. Businesses around the world are facing the brunt of it, with many scrambling to stay afloat. Many industries, including the lending industry are re-evaluating the way they work and changing their internal processes, marketing channels, pricing models, and, in some cases, even their target audiences.

With all these changes, businesses will be entering 2026 with a wee bit of apprehension, not knowing what to expect. It includes one of the more volatile industries, which is highly dependent on the economy’s health. Here, we will look at the state of the lending industry, expectations from 2026, and what you can do to keep your business running.

The lending industry before the pandemic

Analysts projected lending and mortgage businesses to maintain the healthy run they have held since the 2007-08 economic crisis. Unemployment was at a record low, increased tax cuts and higher fund rates contributed to increased profits for lenders – both banking and non-banking.

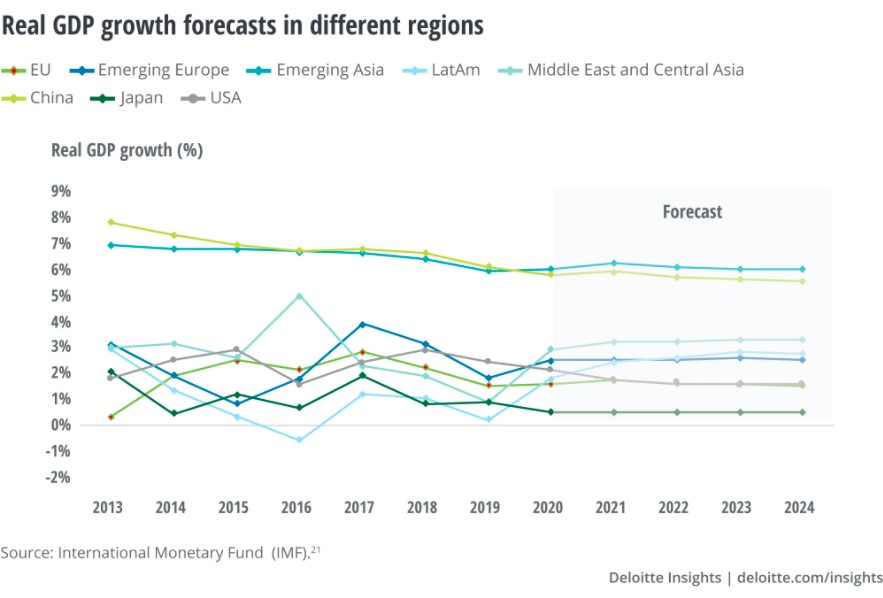

At the end of 2018, the return on capital was at 18%, supported by a strong return on assets of 1.5%. Total US assets were up by 3%, standing at US$ 16.5 trillion (Source: Deloitte). The study also observes that there could be potential disruptions in the industry due to political events such as Brexit or the ongoing trade wars. But the overall forecast was optimistic, with GDP growth expected to be consistent without any dramatic dips or increases.

The lending industry post COVID-19 pandemic

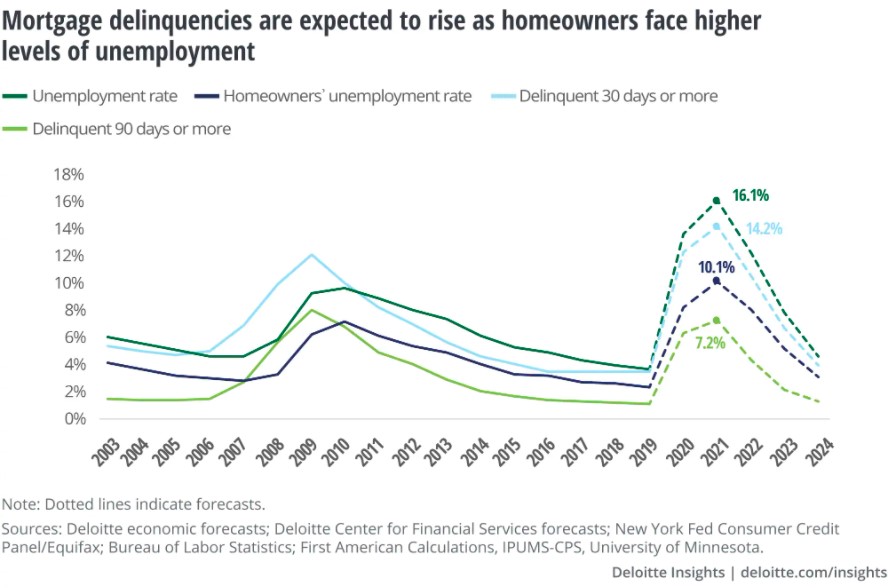

In March 2020, the world turned upside-down with the onset of a global pandemic. The scale and impact of Covid-19 were widespread, hitting businesses small and big around the world and changing the way they function. In the US, unemployment increased by leaps and bounds, with many stolen of their livelihoods. With uncertain futures, borrowers were unsure of how they would pay their next mortgage.

The Federal Open Market Committee reported -2.3% actual change in real GDP in 2020, and projects 3.8% change in 2022. However, it has also been estimated that Big US banks can expect pandemic related loan losses could reach 700 billion US$ in a worst-case scenario.

The Deloitte study notes that borrowers are in a much better position to handle the pandemic compared to the 2007 economic crisis. The CARES Act has provided relief options for federal banked loans, which about 70% of borrowers already have. But this places considerable stress on lenders.

Challenges for non-bank lenders

Increased unemployment will lead to a rise in delinquencies. This situation especially poses a risk for non-bank lenders who have limited liquidity and capital buffers. Deloitte anticipates 39-day failures to peak at 14.2% in 2021, compared to 12.1% in 2009.

Here are some of the more pressing challenges the pandemic is posing for non-bank lenders:

Capacity constraints

There is an increased inflow of customer queries, with borrowers wanting to know about foreclosures and processes or loan modifications. Most smaller lenders do not have the channels or workforce to handle this sudden surge. It could lead to misunderstandings or an illusion of unfair treatment by the consumer.

Operational risks

Most small scale, non-banking lenders are experiencing a crisis of this scale for the first time. It means that they are ill-equipped to handle it, or even more bluntly, they lack the experience. Along with liquidity concerns, this has caused hundreds of lending businesses to shut shop.

Lack of standard procedures

Many borrowers would be looking to make modifications to their loans once the forbearance period ends. But many lenders lack the standard processes that could make this transition easier. It leads to more stress and increased risks of foreclosures.

Capital risks

Most lenders do not have a contingency plan in place to help distressed and at-risk borrowers. All of this would directly impact their ability to minimize delinquencies, loan modifications, and foreclosures.

How lending businesses can cope in 2026

Most financial institutions have prepared themselves for worst-case scenarios. These include sudden economic recessions, natural disasters, cybercrimes, etc. In the case of such emergencies, they have contingency and exit plans in place. But no lender was ready to handle a global pandemic of this proportion, the biggest since the Spanish flu outbreak of 1918.

Lenders are having to quickly revisit their risk management plans and put them into action. Some need to modify programs to suit current times, and others formulate brand new methods altogether. With many lenders closing their businesses, others are battling hard to survive this sudden disaster.

Coping with the pandemic does not just mean ensuring business continuity. The world has gone remote, with most fearing public interaction. The lending industry needs to adapt to this new world and empower its employees to do the same quickly.

Let’s discuss how lenders can do this.

Address customer concerns

According to Accenture, we will see the impact of the pandemic on lenders in three waves:

- Increase in foreclosures

- More outbound collections

- Loan modifications/liquidations

In all these scenarios, customers would reach out to their lenders either for guidance or for reassurance. As a lender, you should be able to answer questions such as:

- Can I close my loan without visiting an office?

- What happens if my credit score changes?

- Can I get a short-term loan till my income stabilizes?

It is essential to address such questions immediately to remove any fears your borrowers may have. Some businesses are offering temporary relief to their customers for 30 to 90 days. You can also do the same if you can afford to. Remember that if you treat your customers with empathy and understanding, they will remember your brand for longer.

The following are the ways to be more customer focused.

- Set up dedicated call centers or task forces to address customer concerns.

- Train your employees to handle incoming queries

- Have separate strategies for new/ in-process borrowers and existing ones

- Prioritize at-risk borrowers

- Educate customers about available options

- Use social listening tools to send targeted messages to concerned customers

- Show customers that you are in this together

Empower your workforce

While focusing on customers, don’t forget about your employees. They are probably equally scared about this new world and the roles that they will be playing. Although some layoffs may be inevitable, emphasize that you are in this together.

If you have a disaster recovery plan in place, inform all your employees about the same. Tell them how you plan to ride this wave and cope. If you are planning to restructure your business, include employees in these plans, or give them prior warning so that they are better prepared.

Your employees will probably want to work from home, given the pandemic. Given this, you should ensure that they have the right tools and means to be productive, regardless of their place of work. Many productivity tools in the market ensure business continuity even in these trying times.

Lending CRM solutions are best to ensure mobility while preserving the productivity of the remote workforce.

Instead of blindly firing employees to cut costs, check if their skills are transferrable. Most employees will appreciate any opportunity to be of use. They will appreciate you for making an effort, and making your employees your ally could be the best way to come out of this with minimal damage.

Revamp your process

Expecting your existing processes to still work for you is not wise. It is essential to create new ways in which your business operates quickly. For example, it does not make sense to keep them all open if you have multiple branches. You need to identify which ones need to stay open and ensure that they are compliant with the new social distancing rules.

With interest rates falling, the government is revising guidelines for loans. It would be best if you modified your policies to fit in these new changes. More importantly, these revisions need to be documented well and communicated promptly to your customers and employees.

There will also be an increased risk of frauds or blind spots that pose risks. Come up with plans or delegate a dedicated resource that handles and mitigates such threats. Consider setting up cross-functional teams trained to assess essential functions that see a spike in volume quickly.

Cut unnecessary costs

Review your loss mitigation processes and try to cut costs where you can. According to PWC, lenders should set up a control tower process to evaluate new expenses so that you can separate the must-haves from the nice-to-haves.

If you have ongoing projects that do not promise immediate returns, it would be wise to stop them. Only focus on things that can add immediate value to your business. It includes marketing campaigns. Review your existing channels and pick the ones that promise the most returns with minimal costs.

Run weekly checks to understand where you are spending money. Look at your vendors and terminate any that do not provide immediate value. Have your IT team review the software licenses they use currently and cut back on renewals that are not needed. Lending CRM can help you here with a complete performance reports for your products, teams, agents, channels, borrowers, and more.

Embrace digital transformation

The most popular way businesses, and not just lending, are dealing with the pandemic is by going digital. Consider automating all your processes to not only save time but also to cut costs.

Most automation tools in the market are easy to use and quick to adapt. These tools focus on solving a particular problem and promise returns in a matter of months. Some of the tools (designed keeping the lending industry in mind) you could use to automate your processes are:

- Loan origination software

- Lending CRM software

- Call center automation software

- Risk assessment software

- Chatbots

We have already spoken about how essential it is to address customer needs and empower your workforce. Numerous tools help you do just that, and at scale. For instance, you can use chat software on your website to quickly resolve customer queries or route them to a call center with an automated call routing software. Handle incoming questions, track highest revenue sources, and manage loan lifecycles with lending CRM software. Integrate with a LOS system to make your whole process seamless.

There are numerous options available in the market. And what’s more, they are mostly cloud-based and offer implementation and training programs. This way, you can reduce costs and ensure that your employees can quickly learn new tools without wasting any time.

Conclusion

We are all aware of these testing times, and businesses are facing the brunt of it. But, by swift action, informed decision-making, and sheer hard work, everyone is trying to survive. It holds for the lending industry also. There will be inevitable losses, no doubt, but how you deal with these losses and keep your business running is the real challenge.

With liquidity risks and the threat of increased foreclosures, lenders in the USA are looking for ways to stay afloat. Also, this is the best time to embrace technology to reduce operational costs and increase process efficiency. COVID-19 is not just a problem for today. It may have forever changed the way the world works. And the lending industry needs to be ready to ride the wave. Choose the right tools that help you drive long term efficiency and productivity.

In a bid to push you along in your digital journey, may I suggest LeadSquared’s lending CRM software that allows you to disburse loans faster with end-to-end loan application management?