Insurtech, better known as insurance technology, is a rapidly developing field within the insurance sector. Insurtech companies are experimenting with a variety of possible game-changers along with improved pricing methods. These include:

- Employing artificial intelligence (AI) with machine learning training to manage the responsibilities of brokers,

- And identify the ideal combination of policies to fulfill a client’s coverage.

In 2021, the size of the Insurtech market was approximately USD 3.85 billion. It is forecast to grow at a compound annual growth rate (CAGR) of 51.7% from 2022-2030.

A significant reason for industry growth is the rising number of insurance claims. The three types of insurance claims that people most frequently secure are auto, life, and residential. There are several players in the Insurtech industry. This list highlights some of the best Insurtech companies in the US.

Top 10 Insurtech Companies in the United States

1. Kin Insurance

Website: https://www.kin.com

Address: Chicago, Illinois, US

Employee Size: 201-500 employees

Funding: The total funds raised from 2016 to 2022 is $238.2M. The key investors were QED Investors, Avanta Ventures, and Alpha Edison.

Kin is an insurance technology company with comprehensive solutions for homeowners. Kin tailors coverage and costs using dozens of property data sets. Their user interface is incredibly intuitive.

The main product Kin at the moment is homeowners insurance. The business specializes in home insurance for locations at greater risk of flooding and hurricanes. This is one of their major USPs, offering the opposite of more risk-averse insurers. Their major features are:

- Automated solutions for changing a plan or filing a claim.

- Use data analytics to create more precise valuation and better underwriting outcomes.

- Eliminates the need for insurance agents

Customer Testimonial:

“After stressing out about being canceled and getting unrealistic quotes from other insurers, I contacted KIN and spoke to Katelyn Rohde. She was very professional and courteous and had relieved all the stress of searching for a new policy. Kudos to Katelyn.”

John Harmon

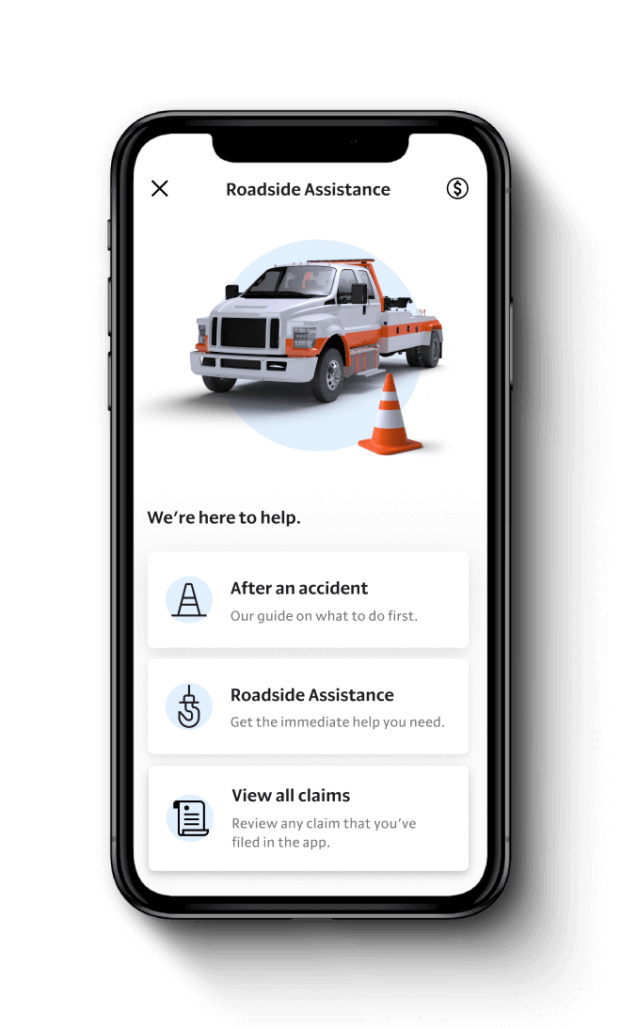

2. Root Insurance

Website: https://www.joinroot.com/

Address: 80 E Rich St, Columbus, Ohio 43215, US

Employee Size: 1,001-5,000 employees

Funding: The total funds raised from 2016 to 2022 is $827.5M. The lead investors were BlackRock, DST Global, and Coatue.

Root insurance is a relatively recent player in the insurance industry. They offer renter’s insurance, property insurance, and auto insurance in several locations. Root’s Unique selling point is its auto-insurance coverage process:

- Usage-based auto insurance is a novel service they provide.

- You must first participate in their test drive process. During the test drive, you give their app permission to monitor your driving habits for a couple of weeks. The quote you receive will depend largely on how well you drive.

- They also provide unique plans for drivers with distinct insurance requirements. Some among them are:

- Medical payments insurance

- Underinsured and uninsured motorist protection

- Personal injury protection (PIP).

This form of pricing may be especially advantageous if you’re a safe driver but pay high auto insurance premiums. By 2025, Root hopes to create a pricing strategy that is free of credit scores.

Customer Testimonial:

“I’ve been using Root for over a year. Amazing coverage and so easy to switch to a new vehicle. Customer service is amazing here as well. I know I won’t be switching any time soon.”

Root Insurance customer

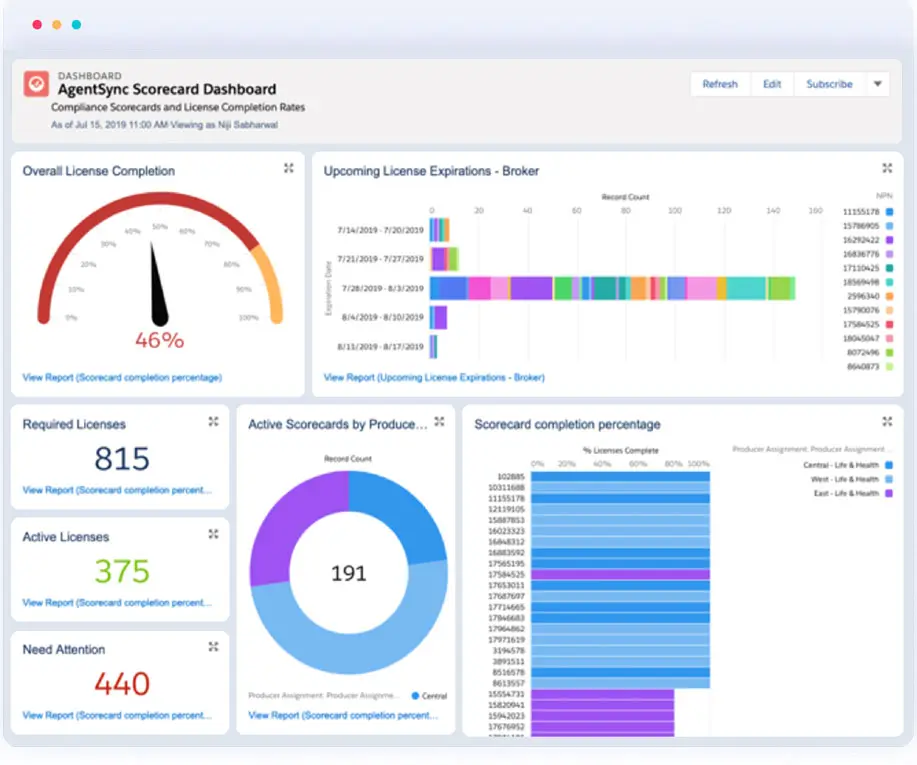

3. AgentSync

Website: https://agentsync.io/

Address: 2734 Walnut St, Denver, Colorado 80205, US

Employee Size: 201-500 employees

Funding: The total funds raised from 2020 to 2021 is $111.1M. The lead investors were Valor Equity Partners, Craft Ventures, and Sanem Fabri.

Insurance companies, agencies, and MGAs experience quick growth thanks to AgentSync, a Salesforce.com-built platform. Software for producer management is the primary interest at AgentSync.

They support the independent agents and brokers in the sector to keep track of licensing and other compliance requirements. They achieve this by providing cutting-edge producer management solutions across the US. AgentSync’s products guarantee that they:

- Reduce friction with the aid of automation and a customer-centric design.

- Boost productivity while maintaining compliance.

- Assist agents in enhancing licensing, contracting, and more.

- Offer consumers some of the quickest and most seamless implementation processes.

Customer Testimonial:

“This highly customizable tool has made it easy to manage licenses for our team of 150+ agents with all different license types. AgentSync gives a clear view of each license status and the ability to process renewals/new license applications with the click of a button. AgentSync has made my job so much easier, and I now have peace of mind knowing that our agents’ licenses are always in compliance.”

Sheovan Lucero

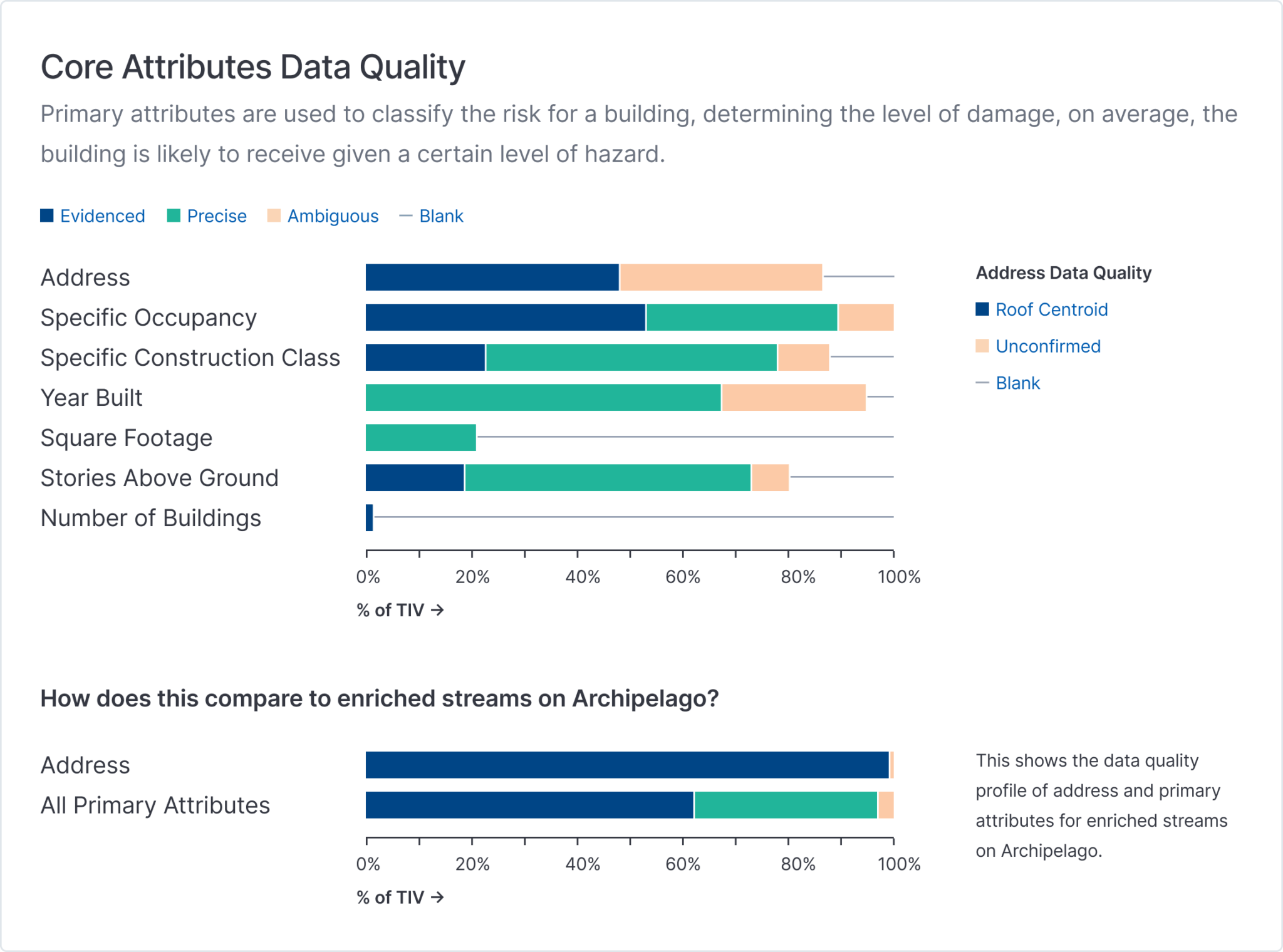

4. Archipelago

Website: https://www.onarchipelago.com/

Address: San Francisco, CA, US

Employee Size: 51-200 employees

Funding: The total funds raised from 2018 to 2021 is $57.2M. The lead investors were Scale Venture Partners, Ignition Partners, and Canaan Partners.

Archipelago Analytics offers AI-powered machine learning to minimize risk and optimize data. By doing this, they offer a stable platform for brokers, insurers, and risk managers to communicate. They do this by offering:

- Centralizing data within their Smarter Sov features,

- Assist you in filtering, examining, and reporting any important findings.

Moreover, they unveiled brand-new improvements such as:

- Risk mapping and Geo-location

- Their Property stewardship data covers property maintenance, renovations, and other measures.

- Construction and occupancy measures.

Archipelago’s solution is ideal for the commercial real estate sector. In contrast, most other solutions in the supply chain focus on specific solutions. Archipelago seamlessly unites the insurance ecosystem with the help of technology.

Customer Testimonial:

“Archipelago has transformed our ability to source and share quality data with our insurers.”

Ian Ascher, Executive Director, Global Risk Management

5. Next Insurance

Website: https://www.nextinsurance.com/

Address: PO Box, 60787, Palo Alto, California 94306, US

Employee Size: 501-1,000 employees

Funding: The total funds raised from 2016 to 2021 is $881M. The lead investors were FinTLV Ventures, Battery Ventures, and CapitalG.

Next Insurance is one of the pioneers in providing insurance for eCommerce businesses and products. NEXT is one of just two carriers that provide digitized insurance coverage to customers in the auto industry. They offer several policies for distinct needs, some of which are:

- General and professional liability

- Workers’ compensation and business owner-related policies

- Insurance for commercial property, tools, and equipment.

- Commercial auto insurance and more.

- They are the sole carrier with an online option for vehicle washes.

- Lastly, they offer competitive plans which customers can personalize for their unique needs.

NEXT promises to provide 24/7 access to Live Certifications of Insurance and Additional Insured. Moreover, with their online system, you can conveniently buy insurance whenever you want.

Customer Testimonial:

“We had been struggling for months trying to find insurance for our small concierge business. It was nearly impossible. NEXT is a lifesaver.”

Miranda BelanskySea La Vie Galveston, LLC

6. Pie Insurance

Website: https://pieinsurance.com/

Address: Washington, US

Employee Size: 201-500 employees

Funding: The total funds raised from 2017 to 2021 is $306M. The key investors were Acrew Capital, Allianz X, and Greycroft.

Pie Insurance is transforming how small businesses purchase and use insurance by utilizing technology. Pie emphasizes on precise, smart pricing and data-driven segmentation.

Both help them effectively match price and risk across several small company models. In turn, they can provide small businesses with insurance at a lower cost. They provide their customers with:

- The ability to pay your workers’ compensation premium as and when you need it through your payment provider. This contains choices for compensation on a fortnightly, quarterly, semi-annual, or annual basis.

- CorVel a reputable business with a wide network of medical specialists handles the worker’s comp claims.

- With Pie, you can receive an online price quote for your company in a matter of minutes.

Customer Testimonial:

“It was a great experience getting the WC coverage for our company. The agent was very helpful and understanding.”

Artur Novak

7. Policygenius

Website: https://www.policygenius.com/

Address: New York, US

Employee Size: 501-1,000 employees

Funding: The total funds raised from 2014 to 2022 is $286M. The key investors were Axa Venture Partners, Global Atlantic, and Orix Growth Capital.

Policygenius is a digital insurance broker. The application process for life insurance is complex. But Policygenius promises to have optimized it by establishing a one-stop shop for your insurance needs.

It focuses on selling insurance, especially life insurance. With the help of Policygenius, you may get custom offers from several reliable providers. Additionally, the platform digitizes the insurance process to the greatest extent possible. They enable consumers to find the best insurance plan at the best value.

They do this by assisting users with the review, research, and comparison of rates for:

- Life insurance

- Long-term disability insurance

- Jewelry insurance

- Travel insurance

- Renters insurance

- Pet insurance

Policygenius offers a broad range of solutions for every client looking for insurance. The site is simple to use and has in-depth FAQs that cover virtually all of your concerns.

Customer Testimonial:

“We had a phenomenal experience with Corey, the Policygenius rep from NC. Our situation is quite unique, yet Corey was able to guide us through the process and get us set up with auto insurance that didn’t break the bank and gives us fantastic coverage. We feel more protected on the road!”

Jaquella Eckles

8. Lemonade

Website: https://www.lemonade.com/

Address: New York, US

Employee Size: 1,001-5,000 employees

Funding: The total funds raised from 2016 to 2020 is $481.5M. The key investors were SoftBank, G Squared, and Digital Horizon.

Lemonade is a full-stack insurance firm fueled by welfare, AI, and behavioral economics. Their main insurance offerings are:

- Insurance for renters

- residential insurance

- auto insurance

- Pet insurance

They mainly operate in the US but also offer some policies in Germany, The Netherlands, and France. The USP of Lemonade is that it effectively deducts a 20% flat cost from premiums. They also contribute to the policyholder’s preferred charity and set aside the remainder to pay claims.

According to Lemonade’s January report, one of its AI algorithms paid out $1 million in claims without human oversight. It is also notable for disbursing claim payments in a jiffy.

Customer Testimonial:

“Truly lovely onboarding + customer support for a normally super frustrating service.”

Jacky Liang

9. Oscar Health

Website: https://www.hioscar.com/

Address: New York, US

Employee Size: 1,001-5,000 employees

Funding: The total funds raised from 2013 to 2020 is $1.6B. The key investors were Alphabet, Tiger Global Management, and Reinvent Capital.

Oscar Health is a private health insurance provider in the US. Josh Kushner, Kevin Nazemi, and Mario Schlosser established it in New York City in 2012. The health insurance firm is thriving thanks to many successful investment rounds. Currently, Oscar Health offers coverage in 18 states. When you buy a plan, you will get a welcome package that contains the following:

- Your plan ID cards

- A list of the features of the policy

- Information on other complimentary perks and amenities. This includes a $400 yearly compensation for gym membership fees.

You can track your journey toward the deductible and see pertinent health concerns via the app and website. You can also count your steps and earn up to $100 in Amazon gift cards annually for hitting your step target.

Moreover, finding EPO suppliers is simple with Oscar Health’s search feature. Interactive maps, testimonials, and ratings are all available when searching for the policy or medications you require.

Customer Testimonial:

“Oscar has always been there when I needed them. Their concierge team has answered all of my questions and they’re always available. They pay their claims without any problems. A good network of doctors is available. Overall, I have been very happy with Oscar compared to other insurance companies I have had in the past.”

Penny Altman from Van Nuys, California

10. Hippo Insurance

Website: https://www.hippo.com/

Address: 150 Forest Avenue, Palo Alto, CA 94301, US

Employee Size: 501-1,000 employees

Funding: The total funds raised from 2016 to 2021 is $1.3B. The lead investors were Mitsui Sumitomo Insurance Company, Ribbit Capital, and Pipeline Capital.

Hippo insurance is a fantastic choice for property owners. It features a comprehensive range of discounts available. These help to reduce your payments and delivers extensive coverage at a budget-friendly price. Their homeowner’s insurance covers basic policies like liability, property, and dwelling. Their best-known USPs are:

- Hippo Insurance’s best feature is its highly responsive team and speedy purchasing process.

- You can get an estimate and get insurance in less time than five minutes.

- Hippo’s smart home deal is also among the most commendable special discounts. When you buy a policy, it comes with a complimentary basic smart home solution.

Hippo insurance is currently accessible across 38 states in the US. They offer reasonable prices, an easy-to-use digital interface, and free additional coverage options for areas like sewage systems and home appliances.

Customer Testimonial:

“Fast, easy, and friendly way to get insurance.”

Philip

Our research methodology

Every Insurtech company on our list is working on developing new tools to improve customer experience. These companies are reinventing consumer experiences and developing innovative business models.

Insurance agents should look into such products to discover what suits their needs. You might find that some of the solutions on this list are just what you need. And in case you’re curious about the selection criteria, they were as follows:

- All the Insurtechs on this list have established a sizeable client base across the United States. For instance, Oscar Health provides insurance for a variety of businesses. Insa Restaurant, Black Ink (accounting service), and DiRaimondo & Schroeder LLP are some of them.

- This list has Insurtech companies that offer a distinct variety of coverages and services. NEXT Insurance focuses on small businesses and eCommerce stores. Whereas, Root insurance empowers clients to get auto insurance based on their driving skills.

- Lastly, all the Insurtechs on this list have relatively positive reviews and ratings across websites. All the companies on the list are moving towards creating seamless insurance experiences.

If you’re looking for a tool to automate your sales process and client journeys, do check out our Insurance Agency CRM—build specifically for producers. Book a quick demo to speak to our representatives.

![[Roundtable] From Traditional to Digital: Building a Customer-Centric Insurance Strategy](https://www.leadsquared.com/wp-content/uploads/2024/07/insurance-RT-popup-1.gif)