Manage your Insurance Sales & Operations Digitally [Download Now]

You must have heard of the overused adage: “Change is the only constant’. Of course, it is true, despite being the cliché that it is. Unsurprisingly, this inevitability of change has also redefined the way a lot of businesses operate today. And if I had to name an industry that has undergone the most drastic change, then it would be insurance. In particular, life insurance.

Evolution of Life Insurance:

A few decades ago, when insurance started gaining prominence, it was just a risk mitigation scheme. Not many were particularly aware of it, and even fewer actively sought it. Now, insurance organizations are broadly classified as life & non-life. While subsets like health & auto insurance have had their fair share of the cake, the sale of life insurance policies still hogs the limelight.

Though more people are actively seeking insurance, the numbers are still not so great. You can attribute this to the fact that users are now spoilt for choices, and they lack the clarity needed to make informed decisions. Which is why life insurance marketing plays such an important role in educating your leads.

Challenges in Life Insurance Marketing:

Aligning your marketing activities to meet the changing demands and interests of your buyers is essential. While it’s easy to deduce that improved customer centricity leads to increased policy sales, the steps which lead to this result are often misconstrued. Here are some aspects that you need to focus on as a life insurance marketer.

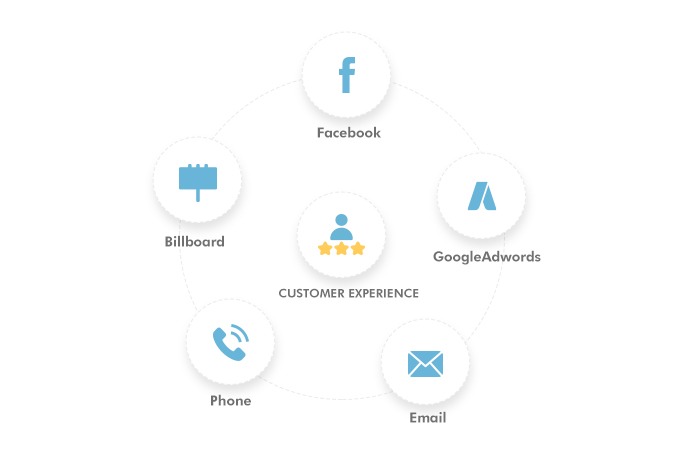

Providing an omnichannel experience:

As far as initiatives go, this needs to be on top of the list. The modern buyer is active on a wide range of channels. Even for research, they tend to use multiple channels, with online channels proving to be the most favored. Given this fact, limiting yourself to just emails or a basic contact center will leave you considerably behind your desired level.

Establishing a good presence across your website, social media, advertisements etc. will put you in a prime position to engage with new potential prospects. Consumers also prefer to talk to an agent before making the actual purchasing decision. This further means that the onus is on your organization to make sure that you provide a seamless, one-stop journey which caters to everything from basic research to the final decision.

Enabling intelligent engagement:

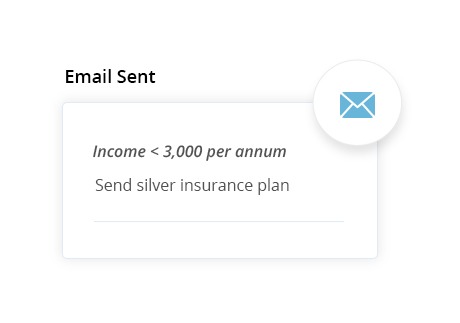

While it is important to engage, generic attempts, irrespective of its volume, no longer create the same impact. Bulk emails and out of the blue calls are met with a frightening amount of disdain. Segmenting the target market and analyzing their behavior helps in gaining invaluable insights into areas like life events, purchasing power and other trends apart from basic demographics of your potential customers.

Engagement, based on these insights, which is sending the right content, to the right person, at the right time is what will help in creating and developing a rapport with your prospects. This kind of ruthless personalization based on acquired intelligence is the yardstick which will set you apart from your competition.

Mobility:

Any strategy which you create should be compatible with all the different types of screens used by people. Our world might be a global village, but it is an interconnected, fast-paced environment where everyone is constantly on the move. This means that even your average buyer spends a significant amount of time on a smartphone.

At times, a prospect might even shift from one screen to another at any point in his purchasing/decision making cycle. However, you intend to drive engagement, it should be compatible with both a web and a mobile device. Providing this ease is no longer an option but an absolute necessity as organizations have already started to adopt digital transformation to enhance customer experience.

What is the solution?

The simplicity of what needs to be done can be quite misleading. Life insurance organizations have been around for a long time and transforming their business process and customizing at scale can be a daunting task. This is why companies have turned towards robust, tailor-made execution solutions for the insurance sector.

Here is how you can make life insurance marketing more automated:

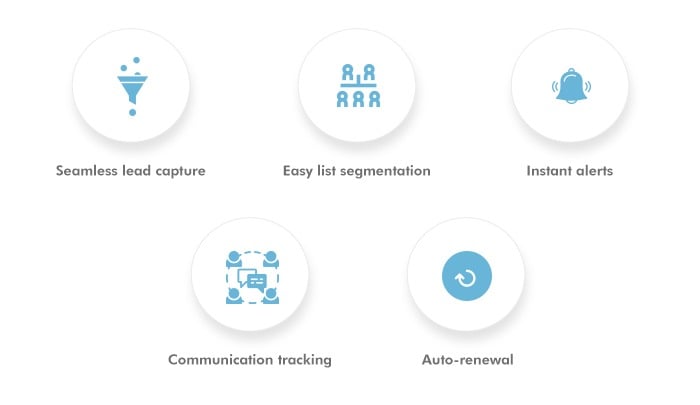

Seamless lead capture:

Life insurance organizations may have multiple channels from which they gather their potential insurers. This could be through online media such as the website, paid ads or even social media. With the growth of their internet, there has been a surge of aggregators such as PolicyBazaar, MyInsuranceClub, and others. You should be able to link to these sites as well and capture leads from there.

In the case of insurance, there are many offline channels as well, such as kiosks in prominent locations, events or your feet-on-street team, who go around collecting leads. You should be able to capture all these leads to your insurance CRM.

Easy list segmentation:

Your life insurance program may have many different categories depending on the policyholder’s income. You would not want to sell a low-income policy to someone on the higher bracket or vice versa. Which is why having clear, distinguishable segments allow you to understand who to target and how.

This will also allow you to nurture the leads according to their segment. You can send educational or promotional emails to each list, or even use these lists to remarket to them using PPC channels.

Instant alerts:

Imagine a lead, interested in policy, responding to your well-thought-out marketing campaign. But, the lead is ignored because no one knew that the lead had to be contacted. Such a waste of effort and a good opportunity lost.

However, by instantly alerting your sales team as soon as a positive action occurs, you can solve this problem. The salesperson can then immediately get in touch with the lead and try to persuade him to insure with you.

Communication tracking:

Sometimes, you may get stumped as to how to keep nurturing the leads that have already signed up with you. They might already be in touch with someone from your team or might have asked for time for consideration.

But what if you were able to know what communications, be it phone or email, that your team has with the leads? Then you would be able to personalize your messages and tweak your campaigns accordingly.

Auto-renewal:

You know those calls that you get asking you to renew your plan. You tend to ignore them and think, ‘I’ll do it later’. This may happen with your policyholders as well. So how do you persuade them to renew their policies?

Automate their renewals, and just ask them for their consent. You can send them a notification stating that their policy is up for auto-renewal and they can cancel if they do not want. This makes it easier for both you and them.

A modern-day Insurance CRM is a powerful tool which leverages comprehensive intelligence to help you identify, nurture and engage with the right prospects. Apart from acting as a central repository for managing your leads and streamlining your digital & marketing processes, a unified solution will also provide mobility for your internal sales teams thereby increasing productivity. Such tools, with their tremendous scope to enhance entire business processes, are definitely a jackpot for organizations looking to level up.

Looking for a good insurance CRM? Why don’t you give LeadSquared a try?