What are the two departments that carry the most weight with customer acquisition?

You’re right. These teams are:

- Sales

- Marketing

The 2018 Nashville Analytics Summit highlighted that aligning sales and marketing is crucial for cutting acquisition costs. Tightly aligned organizations may save up to 30% on customer acquisition costs. Additionally, they experience 20% better customer lifetime value (CLV).

It brings us to the crux of the article. How to calculate your customer acquisition cost, what factors to consider, and ultimately, what can your sales and marketing teams do to reduce CAC?

Let’s get started.

What is Customer Acquisition Cost (CAC)?

Customer acquisition cost (CAC) refers to the cost of getting a new client. It includes the sales and marketing expenditure and operational costs such as resources (or teams) involved in acquiring a new customer.

CAC is a crucial business metric as it determines the growth of an organization. By examining customer acquisition cost, you’ll be able to realize whether you’re generating enough ROI or not.

While we talk about what is customer acquisition cost, it’s equally important to understand what it’s not. For instance, don’t confuse CAC with lead acquisition cost. Often, advertising tools like Google Ads show conversion numbers. But these can be sign-ups and not necessarily paying customers.

Also, there are a lot of variables in calculating the customer acquisition cost. Many businesses fail to understand what goes into their customer acquisition costs. Which is and always should be the precursor to calculating customer acquisition cost. So, before we delve into its formula, let’s examine what contributes to customer acquisition.

Factors that Increase Customer Acquisition Costs

Several companies tend to narrow down the factors that affect their customer acquisition. While a few channels, platforms, or ways to acquire customers are common across industries, there are a few industry-specific examples of customer acquisition that businesses can benefit from.

But, even a slight change in your customer acquisition strategy can lead to inconsistencies when calculating CAC. It can be doubly hard to determine what spending goes into customer acquisition cost as it differs across industries. But you can whittle down this list to the following factors:

1. Advertising and creative costs

These are the investments for website banners, ads, and more. The amount you spend on content creation is generally considered creative costs. It can also include the agency fees (if you’ve hired one), publisher platform fees, or the cost of hiring new employees to help you with the operational tasks.

2. Employee expenditures

It refers to salaries, bonuses, and expenditures you offer your customer-facing teams. These are generally marketing, sales, and customer service teams.

Investing in efficient and productive personnel is usually a good idea. So, if you think it is getting too expensive, pay great care to how you remedy this. Implementing salary cuts or layoffs is only a temporary fix to reduce the cost of customer acquisition.

Instead, figure out ways that ensure no talent goes to waste. You can do this by equipping your team with the right tools to maximize efficiency. Marketing automation, for example, can boost their productivity by automating routine work.

3. Technical or software expenses

The software your advertising and sales teams use is what we call “technical costs.” For example, if you bought an SEO tool to track the progress of marketing campaigns, it would be a technical cost.

Many companies may not realize the significance of technical tools for customer acquisition. But a recent study found that 80% of businesses believe automation helps them send better-quality communications, improve client retention, and acquire new customers.

4. Maintenance cost

Generally, you have to spend money on software maintenance and optimization. This cost would include utility expenses and facility storage fees for large-scale enterprises. It is the money you’d spend on upgrades and changes to enhance the CX.

5. Merchandise and overall production costs

The cost of physically manufacturing content is the production cost. If you’re filming a video, for example, you’ll have to buy a camcorder, build a set, edit the footage, and so on. These costs add up fast, especially if you’re paying someone else to create your content.

These are some of the expenses that contribute to your overall CAC. As I’ve mentioned, this doesn’t apply to every company or brand. But is a general list of the expenses most companies incur over time.

Now that we know which expenses contribute to customer acquisition cost, let’s get into the formula.

Customer Acquisition Cost Formula and Example

Calculating CAC is pretty straightforward once you know the formula.

For example, let’s imagine you own a sneaker brand. Your contributing expenses for customer acquisition in May are:

- $100 on Google and Facebook ads and banners.

- $500 on technical costs for sales and marketers.

- $25000 for the sales team’s salary.

- $25000 for the marketing team’s salary.

- $250 on the merchandising and inventory storage space.

Once we add all these figures, we reach around $50,850 in total. In this month, you manage to acquire 750 new customers. So, the cost of customer acquisition for May will be:

CAC= 50,850 ÷ 750= $67.9

With that, we know how to calculate the customer acquisition cost for a company. If you want to quickly get an estimate on your acquisition cost, use the following online customer acquisition cost calculator.

Online Customer Acquisition Cost Calculator

(Enter your sales and marketing expenses for a given period and the number of customers acquired in that period. You can also enter an approximate value to get an idea of your customer acquisition cost.)

Enter total expense in sales and marketing ($):

Enter total number of customers acquired in a given period :

Your Customer Acquisition Cost is: $

The next step is knowing the CAC benchmarks across industries to know whether you’re in the red or good to go.

So, let’s get right into some of the most well-known CAC benchmarks across sectors.

Industry-wise Average Customer Acquisition Cost

“The biggest challenge in any business is sales, and the cost of acquisition is an inextricable part of it. As compared to other industries, the cost of acquisition is much higher for the hospitality industry, which slows down sales.”

Dr. Joseph Britto, Co-founder and Director, Acron Homes & Hospitality

Getting your ad spend right is half the game, and for early-stage start-ups, the most difficult battle to win.

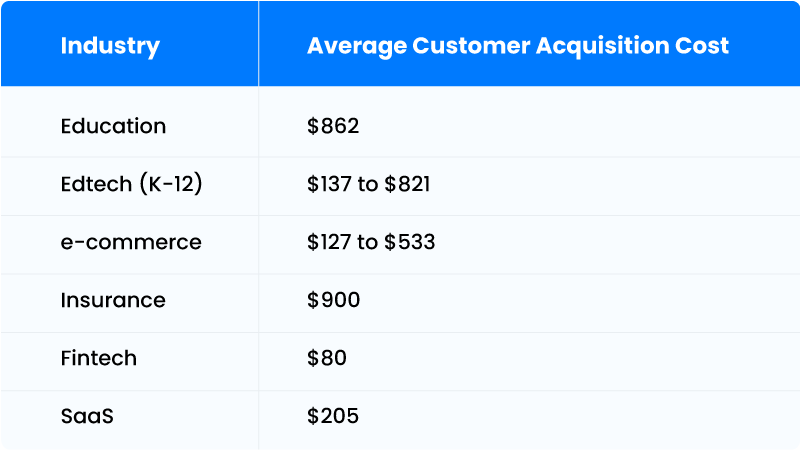

Most businesses strive to maintain their cost of customer acquisition as low as possible. However, the average for each industry varies due to several contexts. Let’s get into some of the industry average CAC worldwide:

Please note that the acquisition cost varies according to the consumer segment you wish to target (B2B or B2C) and the region you operate in. They may also be impacted by socio-economic factors. Use these benchmarks for reference only.

1) Education

Firstly, most educational customer acquisition costs are higher than in other sectors. According to studies, the education industry has an average customer acquisition of $862. This is most likely owing to the education sector’s highly selective nature.

Furthermore, educational advertising has yet to fully expand online. On the other side, ed-tech companies may have much lower customer acquisition cost. The CAC for an ed-tech company in the K-12 space can range from $137 to $821 per student.

Whereas traditional education, particularly higher education, is among the costliest. The sources for expenditure when it comes to higher ed are still largely offline. Word of mouth, rankings, and more are a major influence in the education sector.

2) E-commerce

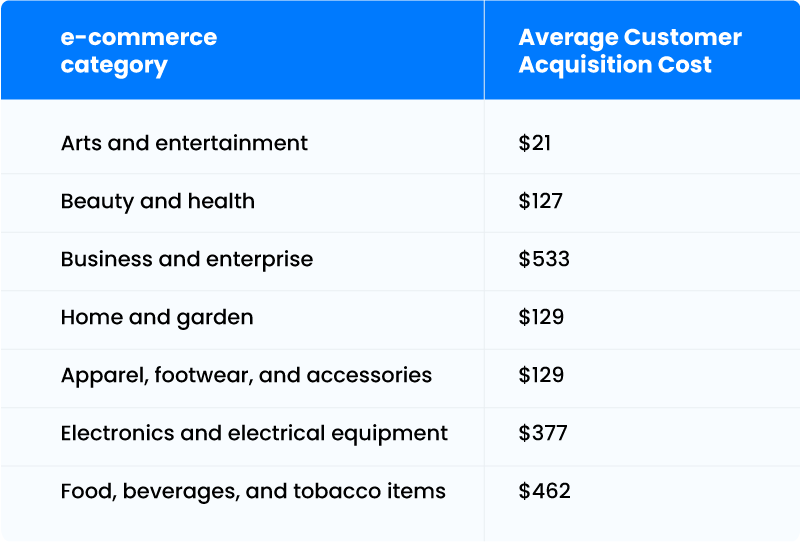

A Shopify survey found the following rates in various e-commerce industries. Ecommerce brands and companies, depending on the product, tend to have low CAC rates. We can attribute this largely to their online presence, which reduces inventory costs. For instance, most e-commerce brands do not operate offline. It drastically reduces the number of staff, rent for the space, and other such expenses.

The mean Customer Acquisition Cost by category for e-commerce businesses with fewer than four employees is as follows.

3) The insurance industry

Insurance client acquisition costs are notably vital because they are the lifeblood of any agency. For both established organizations and disruptors, acquisition marketing has created an imbalance.

Insurance companies have the most expensive customer acquisition costs of any industry. The average cost of acquiring a new insurance customer can go up to $900 per person.

Most insurers spend ages trying to onboard a new client. The lack of proper tech and long-winded processes cause further issues. Insurance agencies must invest in customer onboarding automation to ensure that they don’t incur losses.

4) Fintech / Credit cards

The customer acquisition cost in Fintech depends on the sources through which companies acquire customers. However, the average CAC for credit cards in America is $80.

This is among the lowest CAC rates across industries worldwide. Strangely, Fintech apps have serious app uninstall rates (>35%). Also, the cost of acquiring a customer varies greatly amongst banks. So, these customer acquisition cost benchmarks should be taken with a grain of salt.

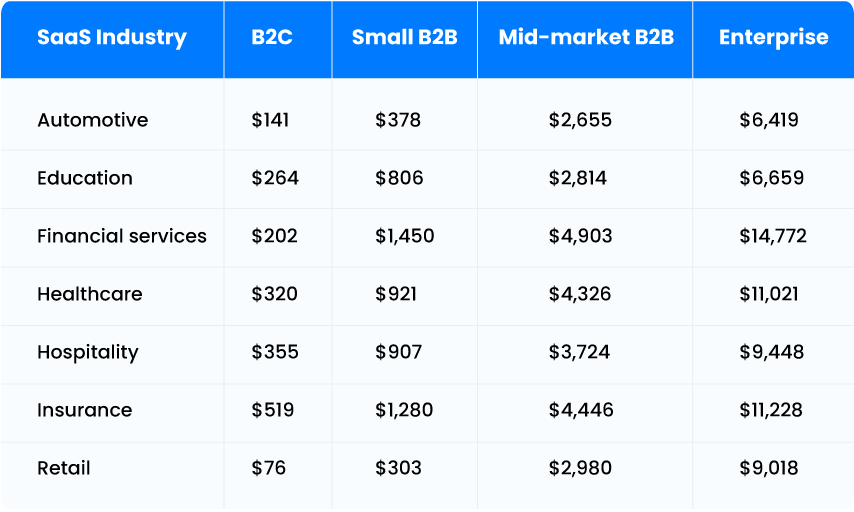

5) SaaS companies

An article by HockeyStack found that the average SaaS company customer acquisition cost is $205.

SaaS CAC is the midpoint of industry-wide typical client acquisition expenses. But, within the SaaS sector, there are several different industries. Another data set by First Page shows the following CAC for SaaS companies.

Now that we have a rough idea of the CAC rates across industries, let’s look at the customer acquisition cost per channel.

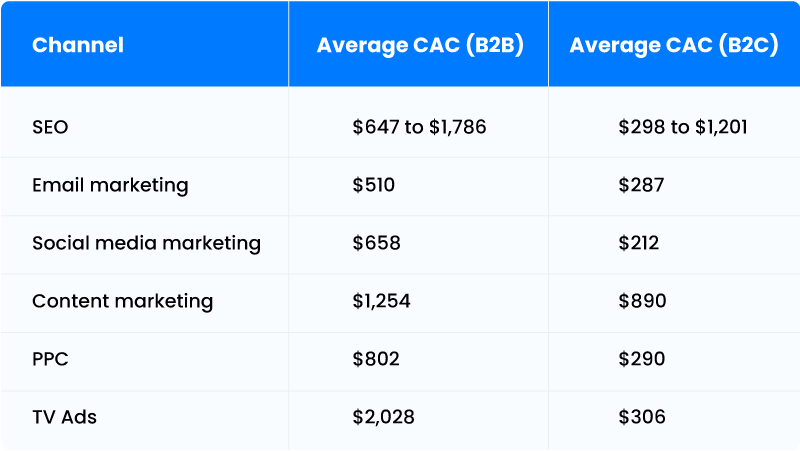

Source or Channel-wise Average Customer Acquisition Cost

Again, the customer acquisition cost varies according to region you operate in and your target consumer segment (B2B and B2C).

Here’s the channel-wise average customer acquisition cost as shared by FirstPageSage.

1. SEO

The practice of optimizing your site so that it ranks highly when searched is search engine optimization (SEO). For SEO setup charges, you should anticipate paying between $4,000 and $10,000.

If you work with an Online marketing agency, you may expect to pay around $1,000 each month. To figure out how much it costs to acquire a customer with SEO, tally up all of your expenses.

Total manpower and other financial investments can be part of this. After that, divide that number by the number of SEO-based conversions. Use analytics software to track the number of conversions.

2. Email marketing

Email marketing expenditures are comparable to the price of running SEO or PPC campaigns. Initially, you should expect to pay anything between $3,500 and $10,000.

Each eligible visitor costs between a few cents and $4, with your Internet marketing agency receiving roughly $500 each month.

72% of adults in the United States also prefer to communicate with companies via email. And because the folks on your mailing list have chosen to be there, it usually generates high-quality leads.

You can also use email automation to follow up with users based on their behavior on your website. You can send them customized content to encourage their progress through the sales funnel.

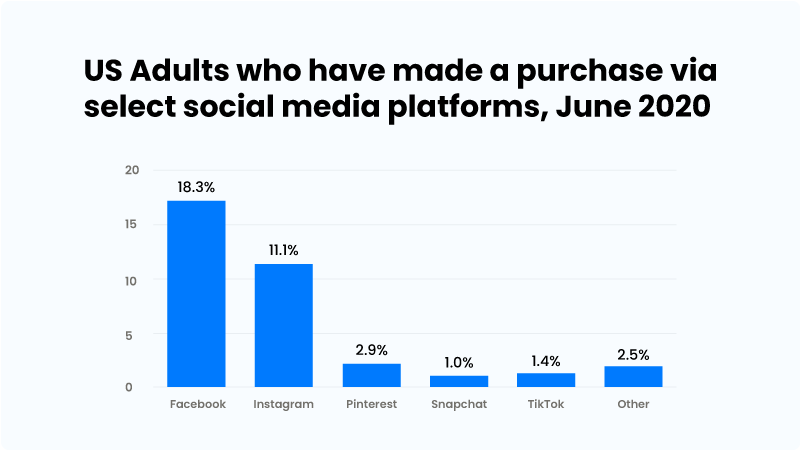

3. Social media marketing

As billions of people are active on social media, it’s obvious to use this channel in your customer acquisition strategy. The June 2020 emarketer survey reveals interesting insights on purchases made via social media platforms.

As mentioned above, the social media customer acquisition cost ranges between $212 to $658 according to the consumer segment. While social media can also contribute to organic customer acquisition, paid or promoted posts are quite popular for instant returns.

Generally, brands employ in-house social media marketing teams to interact with shoppers. They also outsource creatives and posts to digital marketing agencies, whose social media pricing varies according to the engagement duration and deliverables.

4. Content marketing

Initially, content marketing might cost anywhere between $5,000 and $12,000. If you use timeless topics, your content can produce results for years after. You won’t have to pay anything to keep bringing in new clients.

There are no ongoing fees associated with content marketing. As a result, as more clients convert from it, your cost of customer acquisition cost for each content will start to reduce.

Furthermore, content marketing provides value to the purchasing process. It accomplishes this by informing users about items and services they might be interested in.

Consider the case of a perfume company. Write an infographic with recommendations for increasing the shelf life of a fragrance. Users who find your article helpful are likely to share and utilize your tips.

5. PPC

Pay per click ads may look expensive but are rewarding if you aim for quick growth. You can run PPC campaigns on search engines, social media, and public forums.

The only way to reduce the customer acquisition cost in PPC ads is through constant optimization. That is, analyze your ad performance and optimize ad copy, landing page copy, and creatives for conversions. If you go for an agency to help you with PPC campaigns, include the agency fees in your customer acquisition cost calculation.

6. TV ads

TV ads have been a popular channel for customer acquisition for decades. However, with other digital channels in play, it becomes difficult to attribute this source of customer acquisition. One way of measuring customer acquisition through TV ads is by calculating incremental sales.

Finally, with the meaning, industry benchmarks, and sources of CAC out of the way, let’s get into some quick tips to reduce CAC.

Tips to Reduce Your Customer Acquisition Cost

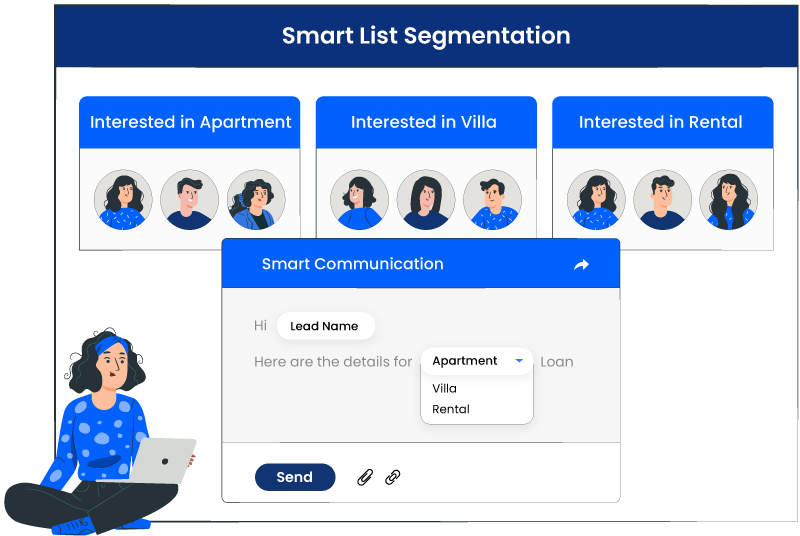

1. Prioritize and segment leads

It is critical to direct advertising strategies and resources to the relevant audience. Create a list of the target audiences for your products and services.

It will be much easier to engage with them on favorable terms after. Marketers in 2022 will segment their audiences and value quality over quantity. Similarly, salespeople plan to prioritize reaching out to interested leads.

2. Concentrate on retargeting customers

Retargeting is a useful strategy for businesses that want to stay in front of new clients. Customers frequently abandon unfinished operations on websites and apps. They may refuse to purchase for a variety of reasons sometimes, just because they got distracted.

A slight nudge in the right direction might sometimes persuade a prospect to make a purchase. In just 4 weeks, retargeting can result in a trademark search lift of up to 1,046%.

3. A/B test and analyze campaign performance

It is critical for marketers to A/B test various aspects of their landing pages. Customers that have a better user experience (UX) with your website are more likely to feel happy with it.

Better UX design can lead to higher client happiness, which increases sales. A/B testing allows a business to discover what its customers desire to experience.

A/B testing product titles, forms, buttons, layout, and more is necessary to improve a website’s landing pages. Companies can use A/B testing to see how slight changes on their website affect click-through rates.

4. Sales and marketing automation

Using a sales and marketing automation solution can help you save money on customer acquisition. Because fewer employees are required to focus on mundane activities, automation inherently saves money.

A corporation can conceive of ways to collect contact information in the future for targeted marketing. Customers might agree to be on email lists in exchange for the value of gaining experience through gated content. Because it frees up other resources, automation boosts conversion rates and lowers acquisition costs.

These are just some simple tips to ensure your CAC rate stays low. Apart from these, another tip is to provide stellar customer service. We are moving into a customer-centric world, and quality customer service can help increase retention and thus reduce customer acquisition costs.

In the next section, we’ll look at tools that can help you reduce the CAC.

Tools that Help Reduce CAC

The best way to measure and meet your CAC goals is to invest in the necessary tools. Here are some quick recommendations.

- CRM tools help you track the customer journey from acquisition to conversion. An example of CRM helpful for both your sales and marketing teams is LeadSquared.

- Every lead is important. To ensure you don’t miss out on follow-ups and meetings, CRM and meeting scheduling tools like Calendly are important. Scheduling tools sync your calendar in real-time—saving time and effort in setting up meetings. These are also helpful when you’ve meetings across time zones.

- If you invest in email marketing, having tools to track email performance becomes crucial. Some good email tools are Mailchimp and SendFox.

- You may want to nurture leads that didn’t convert at the time you acquired them. So, you’ll need a lead nurturing software that allows you to create drip campaigns and supports communication through multiple channels. Again, CRM software like LeadSquared can help here.

- For direct mails, email marketing, or cold calling, you’ll need your prospects’ contact or mailing addresses. Tools like Lusha, LinkedIn Sales Navigator, and Apollo can help you with this.

So, these are some of the tools you can use to improve productivity and hence reduce the cost of customer acquisition.

In your customer acquisition journey, keep one thing in mind—automation. Don’t let your human resources spend their time on mundane, repetitive tasks.

As Henry Ford says,

If you need a machine and don’t buy it, then you will ultimately find that you have paid for it and don’t have it.

So, don’t wait for it. Book a quick demo to understand how LeadSquared’s Sales CRM can help you trace the customer journey with lead source attribution, lead management, and eventually reduce your customer acquisition cost.