Credit Union Digital Marketing Strategies

0 Comments

/

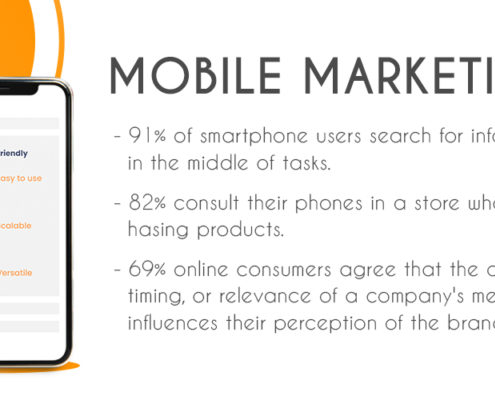

Marketing trends around the world have expanded into the digital…

Digital Insurance: Not an Option Anymore

The year 2020 has brought some unexpected changes in the insurance…

Insurance Agency Management System – What, Why, and How?

You know what they say about insurance companies and paperwork…

[Webinar] How University Admissions Have Pivoted Post Covid

https://youtu.be/JRlENPDBq3I

The global pandemic has brought…

MSME Lending Market Trends 2024

At present, fintech has become synonymous with financial institutions.…

15 Tips for Real Estate Agents and Developers

The fast-paced digitization is changing the traditional sales…

https://www.leadsquared.com/wp-content/uploads/2021/11/neobanks-growth-and-profitability-strategy.jpg4501000Nidhi Agarwalhttps://www.leadsquared.com/wp-content/uploads/2023/12/340-x-156-300x138-1.png Nidhi Agarwal2021-03-18 18:20:482023-12-11 14:50:31Neobanks of the Future

https://www.leadsquared.com/wp-content/uploads/2021/11/neobanks-growth-and-profitability-strategy.jpg4501000Nidhi Agarwalhttps://www.leadsquared.com/wp-content/uploads/2023/12/340-x-156-300x138-1.png Nidhi Agarwal2021-03-18 18:20:482023-12-11 14:50:31Neobanks of the Future

Banking Chatbot: 5 Ways It Helps

The financial service industry is adopting technology at a pace…

Retail Lending Market Opportunities in 2024

In this article, we will explore the market opportunities amidst…

Streamlining Online and Offline Insurance Distribution Channels

The insurance industry has always been at the forefront of significant…

How We Increased Sign-ups by 39% With These Landing Page Design Hacks

(Disclaimer: These are the findings from our previous webinar…

EduTech: New Technologies in the Education Sector

It is not new for Eduprenuers, especially in the online learning…

B2B vs B2C Marketing: 10 Key Differences

B2B marketing is different from B2C marketing in several ways.…

[Webinar Recording] The Love Letters of Enrollment

The secret love language to motivate action from applicants.

Enrollment…

Residential Real Estate Sales Strategy for 2024

The home buyers are regaining their confidence as we move ahead…

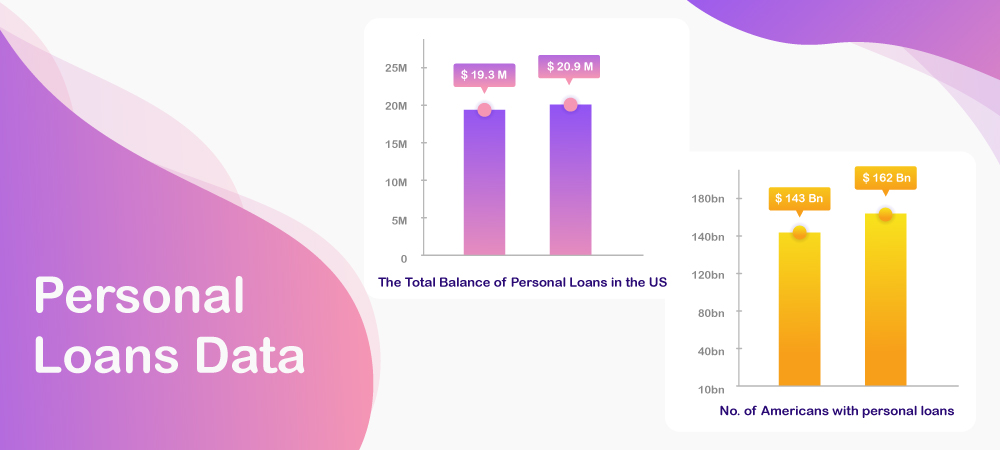

Consumer Lending Trends 2024

The financial industry continues to evolve to accommodate the…

Sales Opportunity Management Best Practices

Contents:Getting started with sales opportunity managementOpportunity…

The Expert Strategy for Scaling Sales in EdTech

The pandemic proved to be a game changer for the Edtech industry.…

Difference Between Lead and Opportunity Management

If you are from sales or marketing, you must have often encountered…

PropTech: A Digital Revolution in Real Estate

People from the real estate space like to keep things traditional.…

Door-to-door Sales App (Mobile CRM)

There are no two thoughts that the pandemic has accelerated…