Technology has shifted the path of almost every industry at an unstoppable pace. Insurance is no exception.

The insurance technology sector is set to increase at a CAGR of 51.7% from 2022 to 2030. Several factors contribute to this rise in demand for insurance solutions.

One of the key drivers of market expansion is a rise in insurance claims. A study found that 36% of respondents in the US wanted to get life insurance in 2021. Additionally, they reported that:

- 102 million Americans remain uninsured or have inadequate coverage.

- This number represents nearly 40% of the adults in the united states.

- And the majority of them state the reason for this is their lack of awareness.

Insurance technology aims to make insurance more accessible and convenient for precisely such reasons. In this article, we’ll explore its various facets of insurance technology.

What is Insurtech?

Insurtech is a portmanteau of the words insurance and technology. It refers to new technologies that seek to improve inefficient insurance practices. It enables the growth, distribution, and customer experiences within the insurance sector.

Buyers today expect ease and convenience when it comes to insurance. Additionally, providers should offer a frictionless smooth consumer experience across different channels. Insurance companies can attract and keep clients by investing in the proper technologies.

Businesses can also empower agents and brokers with insurtech tools to strengthen relationships. The main use cases for insurtech are:

- Finding out what clients require from an insurance provider utilizing data analytics

- Speedier and more precise handling of claims and underwriting

- Converting to digital procedures and e-signatures for a quick, user-friendly experience

- Virtual onboarding of new clients and employees, which is essential in the post-COVID era

- Providing agents, brokers, and businesses with tools to facilitate prospecting

These are just some of the several insurance technologies in development worldwide. In the next section, we’ll delve into the top seven emerging innovations in insurtech.

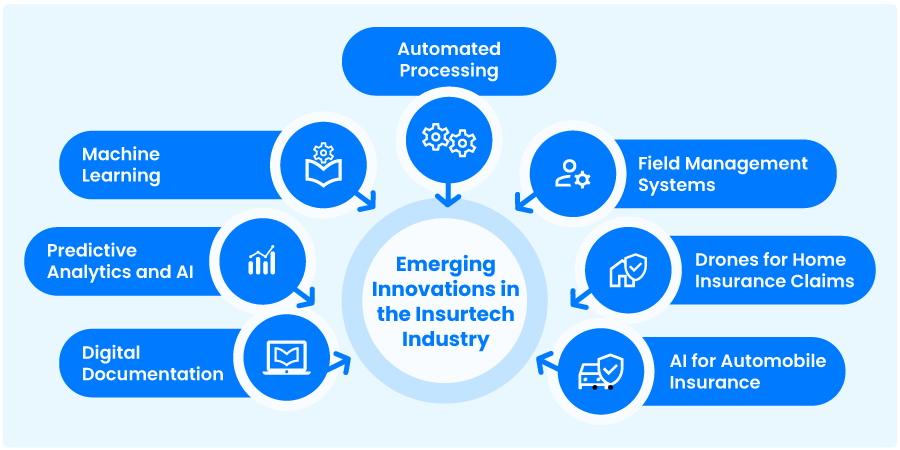

Emerging Innovations in Insurance Technology

#1 Predictive Analytics and AI

Predictive analytics and AI can and have made a difference in the insurance sector. Over two-thirds of insurers reduced claims and underwriting costs with the help of predictive analytics. Furthermore, 60% claim that the data collected has helped boost sales.

Several insurers utilize predictive analytics to gather a range of data to analyze and forecast client behavior. Insurance providers can employ predictive analytics for:

- Risk assessment and pricing

- Recognizing clients who stand the risk of cancellation

- Detecting fraud or risk

- Classifying claims

- Detecting incorrect claims

Corvus insurance is an example of an insurtech that offers similar services. Corvus Insurance uses AI tools in its platform to identify and predict risks. They aim to assist insurance brokers in protecting policyholders and anticipating losses.

#2 Machine Learning

Machine learning improves claims processing in several ways. The first is using automation. Machine learning, to put it simply, is the capacity of a machine to sort through and comprehend data. Insurers use it to forecast rates and expenses for their policies.

An example of an insurance firm that uses machine learning to create high-quality policies is Lemonade. Lemonade is a leading insurer for younger customers due to its fully digital and straightforward insurance purchasing experience. They provide owners and renters coverage using behavioral economics and ML.

They rely on numerous artificial intelligence and big data analytics algorithms. They can power a variety of end-to-end insurance processes thanks to these frameworks.

With the help of machine learning, they have been able to compete with larger competitors on:

- Determining rates for insurance policies

- Speed of user acquisition

- Overall client experience

- Consumer engagement

Insurers can quickly assess customers’ risk if they possess high-quality data. Early risk identification enables insurers to efficiently utilize an underwriter’s time.

#3 Digital Documentation

Most insurers and financial institutions sift through dozens of paperwork daily. Thankfully with the rise of digital documentation, we can end this paper trail. These digital documents are priceless assets when insurers use optical character recognition (OCR) methods.

Optical character recognition refers to tech that can recognize hand-written and digital text. With OCR, firms can swiftly add data to the digital client profile from ID photos and forms. Furthermore, documents can be electronically checked and declined if they are:

- Digitized

- Analyzed

- And stored in a cloud

At the moment, developers strive to enhance the precision of core machine learning algorithms for OCR. This technology is useful when there are discrepancies or inaccuracies in the information. Additionally, with a mobile app, companies can digitally onboard clients and employees.

#4 Automated Processing

Efficiency proves to be the north star for the fastest growing insurance businesses. As the access to digital resources enable buyers to explore and buy insurance online, businesses are speeding up to offer them purchasing convenience online.

Automation is a solution to the three-fold problem of convenience, efficiency, and personalization. The manual processes in claim processing, underwriting, and documents moving from one department to another are decreased which ensures that your team works efficiently at scale.

For example, Ditto Insurance implemented LeadSquared’s Insurance CRM to improve their internal workflows and save a lot of their insurance advisors’ time. Partnering up with LeadSquared helped them:

- Streamline workflows for a quick turnaround time.

- Automate lead management and stage tracking.

- Personalize recommendations based on previous conversations that improved the quality of their advisory calls.

#5 Field Management Systems

Insurtech isn’t just about digitization and implementing new technology, it’s main aim is to integrate and optimize each stage in insurance—from the purchase to managing claims.

In many instances such as home or car loans, the claim raised need to be verified in person and that’s why most businesses have an on-ground team that checks and approves claims. Travelling long distance for a customer facing role, and then returning to update their daily updates on a CRM can be quite taxing for your team.

A field management system, which is integrated with your Insurance CRM, helps managers track the progress of their field team. At the same time, it automatically assigns leads based on proximity, availability, and the rep’s skill set. The mobile CRM application helps them update their progress on the go for better visibility of the rep’s daily activities.

#6 AI for automobile insurance

Automobile insurance, to most people, may seem devoid of the need for technology. But several insurtechs are currently developing software to tackle its unique challenges.

For instance, Root insurance is one such insurtech, investing in digitizing auto insurance. Root primarily markets itself as an affordable insurance choice for safe drivers.

They offer a test drive, where an app keeps an eye on your driving behavior. You can anticipate a lower quote if the test drive reveals that you:

- Drive attentively

- Brake smoothly

- Turn gently

- And stay on the street during safe hours

The Root app measures a driver’s habits using innovative mobile technology. The software provides a rate that matches the driver’s proficiency after analyzing their habits.

#7 Drones for home insurance claims

Insurance companies, or rather their drones, are venturing to new heights. In 2021, insurers are deploying drones more frequently for better customer experiences. Drones are ideal for property risk assessment, inspections, and analysis.

For instance, Farmers Insurance deployed drones in August 2017. They aim to help evaluate risk and damage to houses. The goal was to improve the claims process for clients whose roofs had sustained major damage.

The company is adding machine learning and artificial intelligence components to its drone technology. The drones perform inspections and rooftop checks in the place of insurers. Moreover, the drone automatically sends data to the cloud for risk analysis.

These are just some of several developments in the insurtech sector. If you’d like to learn more about these technologies in detail, you can check out the webinar that we hosted with Sorabh Bhandari, Co-Founder & Director, Riskcovry.

While the potential that these technologies have is immense, each of them come along with their pros and cons for the buyers, agents, and reinsurers.

Pros and Cons of Implementing Insurance Technology

Insurtech Pros for the Buyer

- It empowers customers by facilitating easy access to policy information and insurers. For instance, Root offers an app wherein customers can access insurance-related information instantly.

- Consumers are the driving force behind insurtech. It offers them thorough coverage with personalized policies for their unique needs.

- Insurtech aims to increase customer satisfaction by making its products more convenient. Customers and insurers can save time by checking the progress of claims from their phones. Digitized insurance offers frictionless digital experiences for all its users.

- Buyers are active participants in their insurance journey with insurtech. They can even pick who will appear on the claims jury panel at a review.

Insurtech Cons for the Buyer

- Insurtech is still in its nascent stages. This makes it difficult to determine whether it can be beneficial for you. For instance, several insurtechs offer insurance only in certain states.

- Consumers can access traditional insurance wherever they live. Insurtech products are not as widespread, making them inaccessible to people in different states.

- The mobile-first approach can make it hard to get ahold of customer service agents. Implementing the human element is still a work in progress within the insurtech industry.

- 78% of people looking for insurance call a company after doing some research. Buying insurance is a complicated process. Calling an agent to create a plan is frequently the next step after conducting research. Therefore, many consumers would not benefit from a fully digital approach.

Consumers have a lot to gain from insurtechs. But this doesn’t mean that it’s without its negatives.

Insurtech for Pros for Agents

- Companies like AgentSync offer tools that empower insurance agents. They assist independent agents and brokers across the US. They accomplish this by offering state-of-the-art supplier management solutions. They automate several manual tasks freeing up insurers’ time for more pressing work. Additionally, they preserve compliance while increasing agent productivity.

- With the help of drone technology, agents need to put themselves at risk in high altitudes. For instance, rooftops were manually checked before the use of drones. Now insurers just need to access the data on the cloud sent from the drone.

- Insurtechs like Zywave offer solutions for numerous digital services. Some of which are tools for lead generation, prospecting, quoting, and issuing. These tools are perfect for agents worldwide who must meet quotas and sell successfully.

Insurtech Cons for Agents

- As with most technologies, insurtech does come with a learning curve. Users will have to train beforehand to experience its benefits in full force.

- Insurtech applications are still in their developing stages. This could mean that agents, at times, may not receive highly accurate or comprehensive information.

- Most insurtech solutions cater to consumer needs. This means there are significantly lesser solutions available for agents.

Insurtech for agents is generally more beneficial than not. The pros outweigh the cons in this scenario. In the next section, we’ll get into the pros and cons of insurtech for reinsurers.

Pros of Insurtech for Reinsurers

- Reinsurers stand to gain significantly when partnering with insurtechs. Insurtechs possess a competitive edge that most traditional agencies cannot offer.

- Over 70% of conventional reinsurers employ cloud-based technology. Only 10% use the cloud for the majority of their digital infrastructure. This means that collaborations with insurtechs are all the more helpful in the long run.

- Insurtechs utilize cutting-edge items and technologies to give reinsurers new value-added abilities. Some of these are the capacity to evaluate claims through drone inspections, drastically cutting down claims processing times.

Cons of Insurtech for Reinsurers

- Implementation of any technology can range from weeks to months depending on the reinsurer’s needs. This is why several reinsurers hesitate to invest in insurtech solutions.

- Most traditional insurance agencies view insurtechs as a threat to their existence. But reinsurers can easily overcome this threat by collaborating with insurtechs instead.

- The privacy and protection insurtechs currently offer is not substantial. Insurtechs use blockchain technology to track credit scores in a database. They typically share this among numerous businesses and websites. As they share this information data protection can be tricky.

Digitization is inevitable in current times, so what does it bring to insurance? And more importantly, what does this mean for traditional insurance businesses?

Aligning Insurtech and Insurance

Insurance and Insurtech aren’t as far apart as most people think. The decision between the traditional insurance or insurtech really depends on the customer whether they prefer an in-person interaction or convenience.

But from a business perspective, adopting a few insurtech practices or even partnering with insurtechs can improve the operational efficiency. Insurance businesses benefit from this collaboration as they can maintain the same trusting relationship with their clients and scale faster with limited investments.

Additionally, insurtechs can help them build platforms where a user can select the best policies, raise claims, and cancel or pause their insurance plans whenever they want. Essentially, this partnership benefits insurtechs, insurance companies, and the clients as well.

Although, this transition needs a unified system that integrates the core operations of insurtechs and insurance businesses.

A Unified Platform to Accelerate the Adoption of Insurance Technology

Businesses need a system that integrates their teams and client data on a single platform before they implement any insurance technology. Implementing a centralised platform, such as a CRM, helps businesses align various teams to improve the visibility throughout the customer journey.

LeadSquared’s CRM has helped businesses such as Ditto Insurance, Max Life Insurance, Universal Sompo, and many others, streamline their workflows. It resulted in them understanding their customers better to suggest the right insurance plans which improved conversions over time.

Get in touch with us to understand the best practices in insurance and how you can speed up their implementation.

In Conclusion

Insurance businesses must make investments in new technology. Insurtechs are constantly developing tailored solutions to the demands of specific clients. If you’re on the lookout for insurance technology that suits your needs, follow these practices:

- Make sure to look at reviews, ratings, and customer testimonials before investing in anything. Insurance technology is expensive and difficult to implement. So, do your research and narrow down highly rated companies.

- Insurtechs offer different coverages in different states and regions across the US. You may find different firms with high ratings that fulfill your demands. But if they don’t operate in your state, you won’t be able to access any of their offerings.

- Agents should look into overall sales, marketing, and prospecting technology first. Insurtechs have made strides in this area. But there are several CRMs, prospecting tools, and more offering similar solutions.

- Lastly, reinsurers and traditional agencies need to partner with insurtechs to compete. As time goes by the newer generation expects seamless digital experiences. If insurers fail to meet this demand, they may lose out on a significant market share.

Improving customer and provider experiences is the primary aim of insurtech companies. Customers are always searching for personalized policies, and insurtechs deliver just that. Agents too can benefit from the help of automation and predictive analytics while making a sale.